As 2024 approaches, retailers are trying to forecast what customers are going to want and how tastes may change during the coming months, especially in key categories like alcohol.

In a December webinar for NACS, James Fortescue, senior category manager of beer, wine and spirits for BP, joined members of NielsenIQ’s alcoholic beverage unit to discuss top flavor trends in alcoholic drinks heading into 2024.

One of the main topics of discussion: The rise of bold flavors across all types of alcohol. And nothing better exemplifies the move than the growth of ready-to-drink and flavored malt beverages, with their stronger doses of fruit, hops, heat and more. These include canned cocktails, malt-based drinks like hard lemonades and seltzers, and more. Hard tea sales grew 37% year over year for the 52-week period ended Dec. 2, while hard sodas were up 45% and wine-based cocktails grew 32%.

It turns out that c-stores are particularly strong outlets for RTDs. Nearly half of RTD beverage sales in the U.S. run through convenience stores, according to NielsenIQ data, and the channel saw almost 14% growth this year compared to last year — more than twice the increase seen in other types of retailers.

“We absolutely see the convenience channel being a go-to channel in terms of RTD,” said Jon Berg, vice president of BevAl though leadership for NielsenIQ, in the webinar.

He noted that part of that reason probably comes down to c-stores’ easy in-and-out format when a customer has a craving for a hard seltzer or lemonade.

However, the RTD space is also crowded and growing, meaning that convenience retailers need to make hard decisions about what to stock. Here are three top trends from among those noted in the webinar

Innovation is key

Because the field is so crowded, brands are growing and innovating in a number of different directions, said Kaleigh Theriault, client manager for BevAl thought leadership for NielsenIQ.

“What we see is that brands are choosing one of the paths forward and they're just sticking with it,” she said.

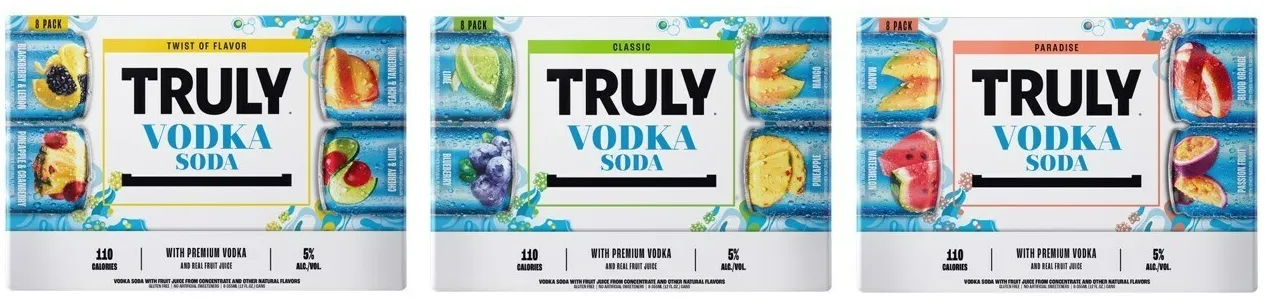

She said some companies are pushing further into bold fruit flavors, noting Gay Water’s vodka sodas, which comes in lime, watermelon, peach and grapefruit. Dad Water, which is fruit-infused tequila water, comes in flavors like lime, blood orange and pineapple jalapeno.

She also noted more overseas influence coming through in products like -196, a seltzer brand from Japanese supplier Suntory that’s breaking into the U.S. The brand uses liquid nitrogen to freeze fruit — hence the name — then pulverizes the fruit, soaks it in vodka and uses that as the base for its zero-sugar drinks.

Looking ahead, the NielsenIQ experts see a few trends coming down the pike for alcohol flavors.

First, they expect growth in drinks that offer a sweet heat, like mango habanero, chili lime or Dad Water’s pineapple jalapeño.

Second, they noted an increased focus on Hispanic-influenced flavors like smoky mezcal, tamarind and tropical fruits.

Finally, they predicted a growth in indulgent flavors like chocolate, caramel and toasted coconut.

RTD is evolving but running up against regulation

Many popular and innovative brands in the alcohol space are malt based. For a while, hard seltzers were the stars, but as they’ve waned, other flavored malt beverages like hard lemonades and Twisted Tea have ascended.

But there’s a growing move toward incorporating more spirits into RTD options to get those specific liquor-based flavors.

“Stores that can sell it obviously are very, very successful with it,” said Fortescue. “It drives basket. It drives transactions.”

While this is great for customers looking for those options, it can cause trouble for convenience retailers thanks to different sales rules for different types of alcohol.

Beer is legal to sell in almost all U.S. convenience stores, NielsenIQ reported. But only about two-thirds of those stores are allowed to sell wine and just 22% are allowed to sell spirits-based RTDs. This means if customer tastes shift too far in that direction, c-stores could get left behind.

“We are looking store by store,” said Fortescue. “If it has a license where [it] can sell spirits, we are looking at that store specifically and carving out space for [spirit-based RTDs], warm and cold.”

More flavorful beer types in favor

Beer is one of the top categories drawing customers to c-stores. It was the third-biggest seller for the industry in 2021, behind only tobacco and packaged beverages.

“We see so much flavor coming through and other styles where in the past, it has been hoppy, but now they're adding in different flavors within those hops segments,” said Theriault.

While it may be tempting to just stock the biggest brands and call it a day, c-stores should watch niche flavor segments that are becoming more popular across the alcohol industry.

For instance, the heavily hoppy flavor of IPAs are a big seller, according to NielsenIQ data. Across all off-premise channels, IPAs sold more than $2 billion over the 52 weeks that ended on Dec. 2. That’s up more than 5% year over year. In that timeframe, sales in the craft hazy imperial/double/triple IPAs category have more than doubled.

Similarly, the presenters noted that sales of hop water — essentially seltzers with hops flavors instead of a fruity or floral taste — has grown 143%, to $22.6 million.

They also noted that cheladas saw nearly 40% gains across all outlets. Cheladas are cocktails made with lager beer and lime juice, and while they can be served in restaurants or bars with a salted rim like a margarita, they also come in RTD varieties.