While a downturn in the U.S. economy is worrisome for all c-store retailers, some are better positioned than others to capitalize in the high inflationary environment.

El Dorado, Arkansas-based Murphy USA is one that is expected to not only weather a potential recession but leverage its strengths to grow further. In fact, the operator of more than 1,700 c-stores in 27 states plans to build at least 500 new c-stores over the next decade, President and CEO Andrew Clyde said during a recent earnings call.

“Even with the cost inflation that we are having, this is an attractive time to build stores,” Clyde noted.

The company opened 36 new stores and completed 32 raze-and-rebuilds last year, and expects up to 45 new stores and up to 30 raze-and-rebuilds in 2023, according to its earnings report.

During an investor presentation earlier this month, Clyde said the company’s new stores are proving to be more productive than its legacy locations.

“When we think about the future, what are we looking at? It's the same story. It's about organic growth,” Clyde said during the Raymond James Annual Institutional Investors Conference in Orlando, Florida. “The new stores have higher comps ... [and] the high fuel margins and the environment we're seeing accentuate new-to-industry store economics.”

While the costs for building new stores require an extra 2 to 3 cents per gallon performance to be able to get the same returns, Clyde said, “fortunately, we’re earning over 10 cents per gallon higher than ... the old performance we're at. So we're generating even higher returns as a result of that.”

To further boost profitability, Murphy plans to capitalize on the economic climate and fuel margins; better utilize data from its loyalty program, Murphy Drive Rewards; and leverage food and beverage offerings and lessons from its QuickChek acquisition, Clyde said.

Economic pressures = Murphy growth

While some large operators are struggling, Murphy is realizing sales and operational success in a tough economic climate. Its net income jumped from $108.8 million in the fourth quarter of 2021 to $117.7 million in the fourth quarter of 2022, and nearly doubled from $396.9 million to $672.9 million for the full year.

A downturn in the economy plays into Murphy’s operating model well, as does its setup adjacent to Walmart lots, according to Brandon Lawrence, president of Fuel Insight and a former fuel data analytics supervisor with Murphy.

“On the fuel side, you have all these pressures on inflation … [and] their everyday low price strategy really resonates when people are feeling the pinch at the pump and in their wallets,” Lawrence said.

Murphy USA’s challenge is to “build on those economics in the face of stagnant fuel demand, normalizing retail margins and increasingly savvy competition,” Lawrence added.

The company’s higher structural margins create more opportunity to invest in lower prices, Clyde noted during the Raymond James conference. “The volume/margin tradeoffs made by others perpetuate MUSA’s ability to grow share,” according to a company slide deck presentation.

Fuel margins are now recovering after their initial freefall in 2022 due to COVID-19, Clyde said. “High volume retailers should outperform,” he noted. He aded that the “widening price differentials” compared to other retailers allows Murphy to capture customers trading down to a “value attractive” option.

Murphy closed the fuel margin gap with peers in 2022, bolstered by the market fall-off in the third and fourth quarter of 2022, Lawrence noted. The company’s margin differential was 14 in the third quarter and 13 in the fourth quarter of 2022.

“MUSA is able to take greater advantage of market swings, enabled by their high volume model and proprietary fuel supply chain,” Lawrence noted.

Plus, the company has a leg up with its focus on tobacco versus some other c-store companies.

“People are exiting the tobacco game, and they are gong to be that low-cost provider,” Lawrence said.

Leveraging the QuickChek acquisition

Clyde expects Murphy’s significant expenses — total store and other operating expenses were more than $149 million higher last year than in 2021 — to decelerate in 2023 as the company further integrates QuickChek, which it acquired in 2021, and as inflation begins to cool off.

The QuickChek stores have higher volume and higher merchandising performance, Clyde said during the Raymond James conference, which is bolstering the company’s bottom line.

“When we think about the future, what are we looking at? It's the same story. It's about organic growth."

Andrew Clyde

President and CEO, Murphy USA

To continue growth over the next decade, Murphy plans to “execute distinctive branded [food and beverage offerings],” according to the presentation.

“Our store of the future takes advantage of the lessons from the QuickChek acquisition in terms of how Murphy USA and its 2,800 square foot stores participate in grab and go categories of nationally recognized packaged food items,” Clyde noted.

While Murphy Express stores will likely not add a fresh foodservice program — it would compromise its everyday low cost format, Lawrence noted — Murphy now has QuickChek’s expertise in food and beverage.

“If they ever need to make that pivot and introduce a food and beverage program, they have that [QuickChek banner] there,” said Lawrence.

Growing loyalty with Murphy Drive Rewards

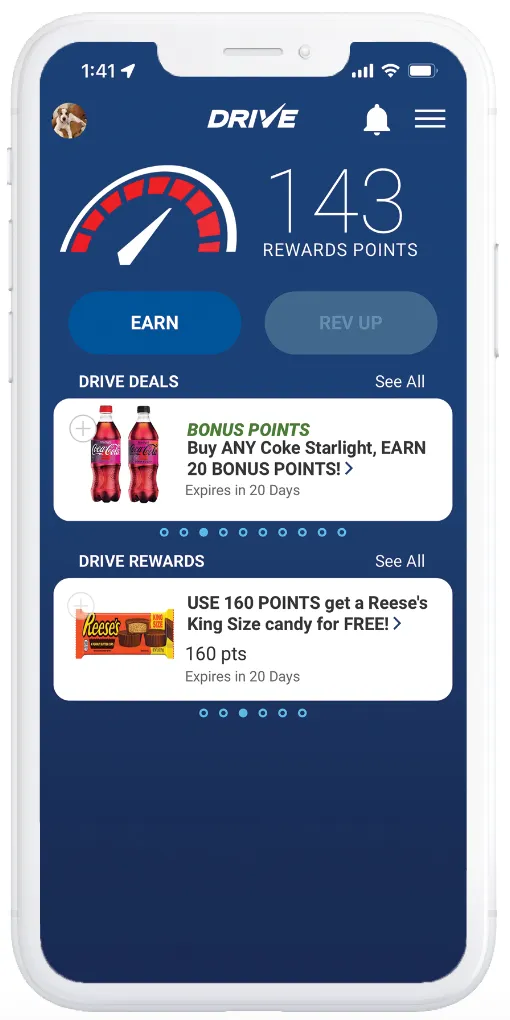

Murphy Drive Rewards is arguably one of the industry’s most successful loyalty programs. It boasts a whopping 3.8 million active users and is utilized in more than 60% of the company’s merchandise transactions, Clyde said.

Murphy is taking on a “digital transformation” to improve the reach and effectiveness of its Murphy Drive Rewards loyalty platform, Clyde said on the recent year-end earnings call. The company plans to leverage customer shopping habits and transaction data to customize its offers and trigger more upselling opportunities, as well as optimize pricing and assortment.

Insights from Drive Rewards will also inform a redesign of the QuickChek loyalty program to increase brand awareness and attract new customers, according to Clyde.

DriveRewards data has also helped Murphy with labor planning, and the company plans to further utilize the data to improve QuickChek’s labor planning, he said. The company is also planning to better utilize customer data to offer personalized promotions, according to Clyde.

“With 2 million transactions a day ... presently going through our loyalty program, we have unparalleled access to data. We’re taking advantage of it today,” Clyde said at the Raymond James conference.