Dive Brief:

- The increase in the cost of items in convenience stores slowed down in the first quarter of 2023 for the first time in almost two years, according to the U.S. C-Store Landscape Q1 2023 report from Circana.

- Still, consumers remain highly price sensitive after more than a year of record inflation rates, with more than three quarters of those polled by Circana saying they plan to buy more value brands in the next six months.

- Private label sales continued to see gains, up 7% quarter over quarter, but that lagged the growth among national brands for the same three months. It’s the first time in over a year than private label has grown slower than national brands, the report showed.

Dive Insight:

U.S. inflation has been easing in recent months, with food-at-home prices increasing at a 7.1% annual rate in April, down from the 8.4% rate seen the month before, according to the U.S. Bureau of Labor Statistics.

At convenience stores, per-unit cost increases came out to 5.9% in Q1, compared to 7.3% in the fourth quarter — marking the first sequential quarterly decrease since Q2 of 2021. The report attributed this to a combination of lower inflation and an increase in customers trading down to cheaper items.

As conditions ease, optimism among consumers is beginning to rise. The U.S. Index of Consumer Sentiment, a monthly index posted by the University of Michigan that measures how healthy consumer think the economy is faring, hit 62 in March 2023, up from 59.4 in March last year year. Meanwhile, 65% of consumers said they think their household’s financial health will improve in the next six months, higher than in past years, according to a Circana consumer survey in February.

However, 57% of polled by Circana still said their households are making sacrifices to make ends meet and almost 80% are planning to buy more value brands in the next six months. This has led to an increase in interest in private label across all generations of shoppers, the report said.

Private label growth in C-stores slowed every quarter for the last year and dropped under 10% in Q1. Despite this fact, private label goods continue to make up a sizable percentage of the sales, representing on average 6% of items in the store but 9% of overall dollars.

The report suggested stores look at increasing their assortments of value items and leveraging private label goods to offer better value to customers in certain categories.

Looking beyond price, the report found that after several months of outperforming QSRs in the foodservice arena, c-stores have been losing ground to them since late 2022. It noted QSR promotions as one potential influence on the trend, and also that coffee customers are leaking to QSR competitors, with 82% of those who bought coffee in c-stores also buying from QSRs in the last year.

Top food categories for convenience retailers included pizza, salty snacks, hot dogs and cold cut combos.

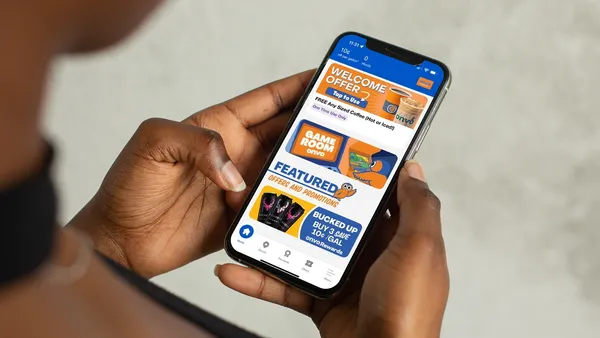

The report also noted that digital sales continue to grow in the convenience store channel, with e-commerce sales up 7% in the first quarter and over 12% for all of 2022.