For every 7-Eleven, which has the resources to create a proprietary delivery app with 30-minute service in major cities, there are many chains that can’t afford to build an e-commerce presence or delivery app themselves, or lack the expertise to do it right.

Enter Vroom Delivery, which helps chains build out those e-commerce and delivery options and keep them up-to-date without large amounts of manual work.

Vroom was built to serve the particular needs of convenience stores. Founder and CEO John Nelson said he and his brother first developed the app to help their father, who was looking for a digital solution for a chain of c-stores he owned at the time.

“We looked around and no one was building for this space,” said Nelson in a recent interview. “Tons of people were building basic menuing services for restaurants, there were a number of big grocery apps out there, but no one for this space. So we built the first iteration for him.”

After building out the app for him, they looked around and saw that the convenience space was still being underserved, and Vroom Delivery was off to the races.

The company completed its most recent funding round in November, including funding from three of its current customers — Wesco, Hutchinson Oil and FavTrip. The amount of the funding round was not disclosed

Nelson recently sat down with C-Store Dive to talk about the needs of the convenience store space, how their company works with other leaders in the space and how Vroom Delivery is trying to stand apart from the competition.

This interview has been edited for length and clarity.

C-Store Dive: To start, let’s talk about what Vroom Delivery does. How do you explain what Vroom brings to the table to a prospective customer?

NELSON: Vroom is really the only comprehensive e-commerce platform that was built from day one specifically for the convenience industry. It was never pivoted from a restaurant menuing service or a grocery service, which means that we've been building everything to allow the online shopping experience for convenience stores to mirror the in-store experience.

We integrate with third-party couponing. We fully automate the menus. So when I talk about having 2,000 or 3,000 products, that's with zero maintenance. If it's in your price book, it'll show up online. If you run out of stock, we’ll remove it.

And then on the fulfillment side, we have some stores doing their own delivery. So we've got tools for their drivers to do things like route planning and digital signature collection. If they want to outsource to third party, we've had very low rates with some of the top third-party delivery providers in the space like Uber [Eats] and DoorDash.

We accept all the traditional payment methods, credit card, debit card, but we also are the only e-commerce player in the convenience space and one of only nine in the whole country that can accept online SNAP or EBT.

How much of a lift was it to get SNAP/EBT built into your ecosystem?

NELSON: It was a year-and-a-half-long process, because you have to contract not just with the government, but you have to get a contract with a specific credit card processor that's been approved to do it. And then each retailer needs to apply individually.

We have to handhold some of our retailers through the process, but those who've done it have seen really good results. We've had a few now, they're seeing up to 20% of orders containing at least one SNAP-funded item.

Can you talk about what sort of chains benefit most from integrating a delivery program?

NELSON: The stronger the brand, the better they're going to be able to push it out.

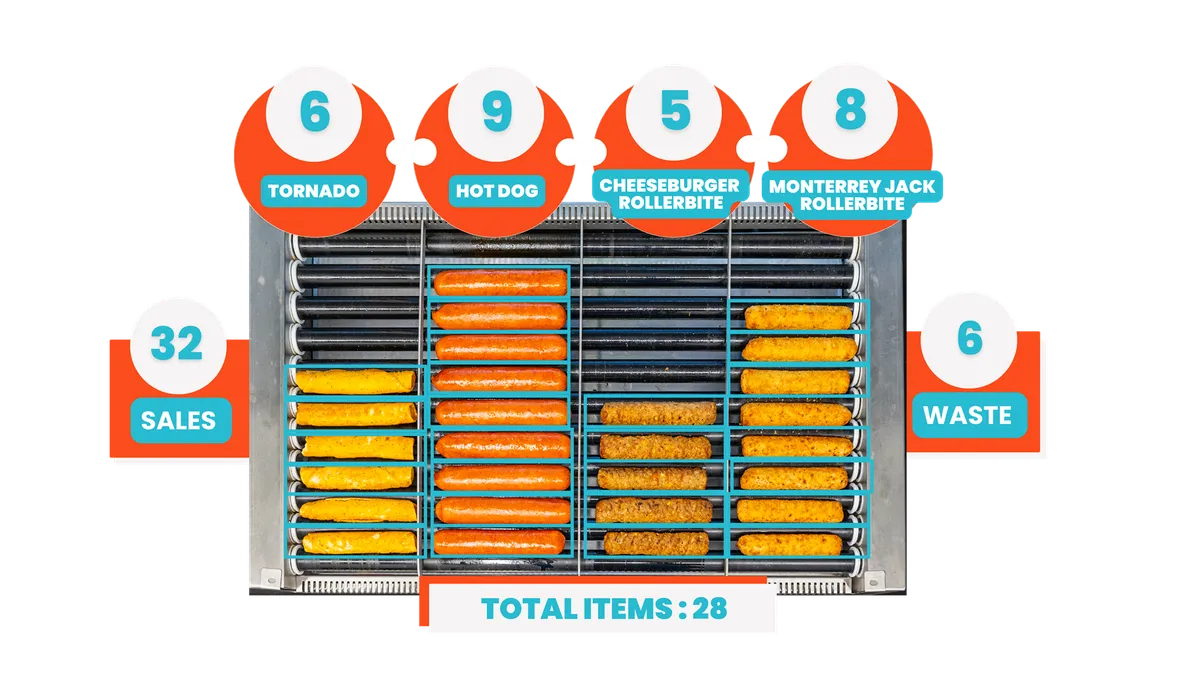

But there's not really a one size fits all. We see different types of chains have different types of successes. So we have some chains that are very robust in the food sector. Other [companies] are more traditional c-stores, lower food offering but still doing strong business in the CPG items.

And then there's a difference between rural and urban. Some of the best-performing stores on Vroom are in relatively small towns, where you have large-format stores that are making pizzas in house, they're making sandwiches in house. But they also have, you know, a large basic grocery offering [and] the age restricted items, beer and cigarettes and stuff like that.

Those are the types of operations that see very large baskets as well. Our average delivery transaction across the whole platform is over $40. For some retailers, it's actually close to $50.

When these companies are adding items to their menu, or when they're out of items, how do they update that in the app?

NELSON: So for the retailers, we have back-office integrations with all of the major back offices — PDI, ADD Systems, KRS, several other smaller ones. We're ingesting those, and we're getting information on pricing, promotions, and also SKU level. So for retailers that are on item-level inventory, we're getting those daily reports, and if you run out of 20 items in a day, we pull them off the menu. We have a CPG database of hundreds of thousands of products that have been already pre-categorized, so if you add 20 new Cokes, we'll just add them automatically. There's zero maintenance required from the retailers.

How have your c-store customers fed back into how you develop your app?

NELSON: Basically 100%. This level of automation became a big priority for us over the pandemic, because everyone was familiar with the labor shortages. But a lot of people weren't as aware of the depth of the supply chain issues and the level of out-of-stocks that a lot of stores were experiencing. So even trying to maintain a slimmed-down menu of a few hundred items could be challenging.

By building this level of automation that doesn't require a human to go and try to figure out what's in the store on a given day, it brought the out-of-stock rate from like 10% of orders down to sub 1%.

We know from talking to our retailers what needs to be done next, and what the priorities are.

What sort of speed demands do the stores you work with have, and how are those timelines conveyed to the stores’ customers?

NELSON: For a chain that wants to move very fast, we can get hundreds of stores up in a few weeks because the automation isn't just for updating products, it's also for creating the stores, adding products and stuff like that. We launched with a chain called H&S out in California, about 160 or 170 stores, give or take. We got basically all their stores online in two weeks.

[The timing is] less about setting up the tech, because that's what we can do very well. It's more about if a chain is launching their delivery program for the first time. You want to make sure your in-store people are familiar with the process. It's not just working with the system, you have to pick items you need, and you have to send the call to DoorDash to come pick up the items.

And there's a marketing element to it too. You don't want to just turn it on and not tell anybody.

And does the company do all of the marketing for letting their customer base know? Or does Vroom have anything to help them out?

NELSON: Most of the marketing will be done by the stores, through in-store signage, proprietary apps, loyalty programs. But we do help them on some things that we're particularly adept at, like, we've co-run a number of social media campaigns. With some of them, we have better capabilities to target certain people.

How does delivery differ for a convenience store as compared to restaurants, or large retailers like Walmart or Amazon?

NELSON: Convenience orders tend to be larger than the average restaurant order, but significantly smaller than the average grocery order. But because of that size and nature, and due to the fact that compared to a grocery store, just physically, convenience stores are smaller, it's much easier to do quick, on-demand deliveries through the convenience channel than it is for groceries. Most [grocery stores] won't deliver your groceries in under an hour, unless you happen to live in a really dense urban environment where those systems are in place. So if you run out of milk, or you need to get pizza late-night, or cigarettes or whatever, it's a way to get those items quicker.

Delivery companies really sprouted up as COVID-19 made delivery more vital. But now we’re seeing many of them fade away. How do you make sure Vroom has staying power?

NELSON: A lot of companies jumped on a lot of bandwagons without really understanding the industries. I think it's a zero-sum game. Most of those companies are going to fail. Most of them have, in fact, even in the dense urban environments.

But you've even seen some of the darlings, like Gopuff, struggle because they're trying to own the whole supply chain. They've got the warehouses, they've got the inventory, they've got the drivers, they've got their ecommerce platform, they're trying to do a lot of different things.

We're not trying to build a delivery force to try to rival these guys who have got it down nationwide. We're not trying to compete in the loyalty space where you have some very big players that know that sector.

Your company partners with a wide variety of other app and mobile companies, like Punchh, DoorDash and Rovertown. Can you talk about how you choose which partners to reach out to?

NELSON: It's dependent on the deal. Often times it's coming directly from the loyalty company. So for example, we're actually the vendor for PDI. So it's their sales team that's out there selling Vroom. And in a deal like that, it's obvious that we're going to be working with PDI on the loyalty side, but they may or may not have the app. So we may be residing within PDI’s app. Or Rovertown sometimes has mutual customers between us, and then we'll work with [them]. In fact, we have the most app-mutual customers with Rovertown, and so we're constantly referring each other deals.

Because we're not competing with any of these companies on their core competencies, we're not a threat to any of them. And in fact, we're usually the best option for their customers.

How do you see the trajectory for Vroom over the next couple years? Any features you’re working on that you can talk about?

NELSON: We have some big ones that, unfortunately, I'm not ready to disclose. But, in general, our goal, as a company is to be that gold-star standard for the industry. So, deeper integrations into the c-stores’ tech stack continues to be a big driver.

There's a few big projects we have ongoing right now. Continuing to bring new features and functionalities to our retailers, continuing to drive down things like credit card costs, drive down fulfillment costs and bringing potential new revenue streams to our customers. There's a lot of platform enhancements on our board for 2023.