This article is the second in a three-part series exploring how DoorDash has become the dominant third-party delivery aggregator in the U.S.

At the height of the COVID-19 pandemic, when many stores were closed and people were stuck at home, Walgreens wanted to serve its customers in the safest, most convenient way possible. The company partnered with DoorDash in July 2020 to provide on-demand delivery of health and wellness items, household essentials, groceries, beauty products and personal care items, said Stefanie Kruse, group vice president of digital commerce at Walgreens.

“[DoorDash has] a very strong history of being able to play in the on-demand delivery space and meeting customer promise times very quickly,” Kruse said. “Seeing the work that they had done in the food delivery space gave us confidence that they could do something similar in the retail and convenience space.”

Getting Walgreen’s delivery up and running with DoorDash took a matter of months. Once contracts were signed and terms were negotiated, it was just weeks before the service was live, Kruse said. Walgreens had application programming interfaces and services in place that allowed it to integrate with DoorDash to bring on-demand delivery to market quickly, Kruse said.

DoorDash’s mobile app presence, technology and scale aligned with both Walgreens’ size and its needs. Because the delivery aggregator operates in just about every market in the U.S., it was relatively easy to extend delivery to Walgreen’s 8,000 stores, Kruse said.

“Being able to have a nationwide presence and being able to deliver for our customers nationally was really important,” Kruse said.

Walgreens is just one of many retailers that have become a part of DoorDash’s platform as the delivery company expands into new verticals. Although DoorDash started as a small restaurant delivery company based in Palo Alto, California, in 2013, it has since grown into multiple categories, including convenience, grocery and other retail verticals. In the last few months, the company has secured partnerships with Sephora, Tractor Supply, Dick’s Sporting Goods, Raley’s, Grocery Outlet, Sprouts, Giant Eagle, Weis Markets, and other retailers.

“While we started with restaurants, the goal from the beginning was to be able to bring every shoppable item to your doorstep within minutes, not hours or days,” said Shanna Prevé, VP of enterprise sales and business development at DoorDash.

Profitability through density

Since launching the convenience marketplace as its first non-restaurant category roughly three years ago, DoorDash has seen significant growth. During the third quarter, this category improved variable profit and is expected to reach positive variable profit this year, executives said in the company’s Q3 2022 shareholder letter. Variable profit is determined by subtracting order management and support costs from revenue. Grocery’s marketplace gross order value increased 100% year-over year during Q3, with profitability improving quarter-over-quarter and year-over-year for DoorDash.

“By expanding beyond restaurants, we believe we provide existing consumers more ways to leverage our service and new consumers more ways to engage with us for the first time,” the letter said.

The percentage of consumers whose first DoorDash order is from a non-restaurant has grown, executives said.

“The key to profitability in this business is density,” said Michael Schaefer, head of beverages and foodservice research at Euromonitor International.

The more orders available in a given area, the less distance drivers have to travel to serve those orders, and the easier it is to maximize profitability on larger orders, he said. DoorDash is comfortably the biggest U.S. player for restaurant delivery, which means it has a larger courier base that makes it easier for the company to attract other players like grocery and convenience stores.

Not only does DoorDash have a dense driver base in urban areas, but also in suburban areas, an area that has been the company’s strength due to reduced competition in these markets, Schaefer said.

That doesn’t mean growth in these categories will be easy. Nicholas Cauley, analyst at Third Bridge, said while DoorDash has some of the best restaurant selections among third-party delivery providers, it still lags behind its competitors in non-restaurant categories.

“Retail and grocery partnerships will be a growth driver for DashPass, which will also create an opportunity for higher average order value,” Cauley said.

Finding depth with grocery, convenience

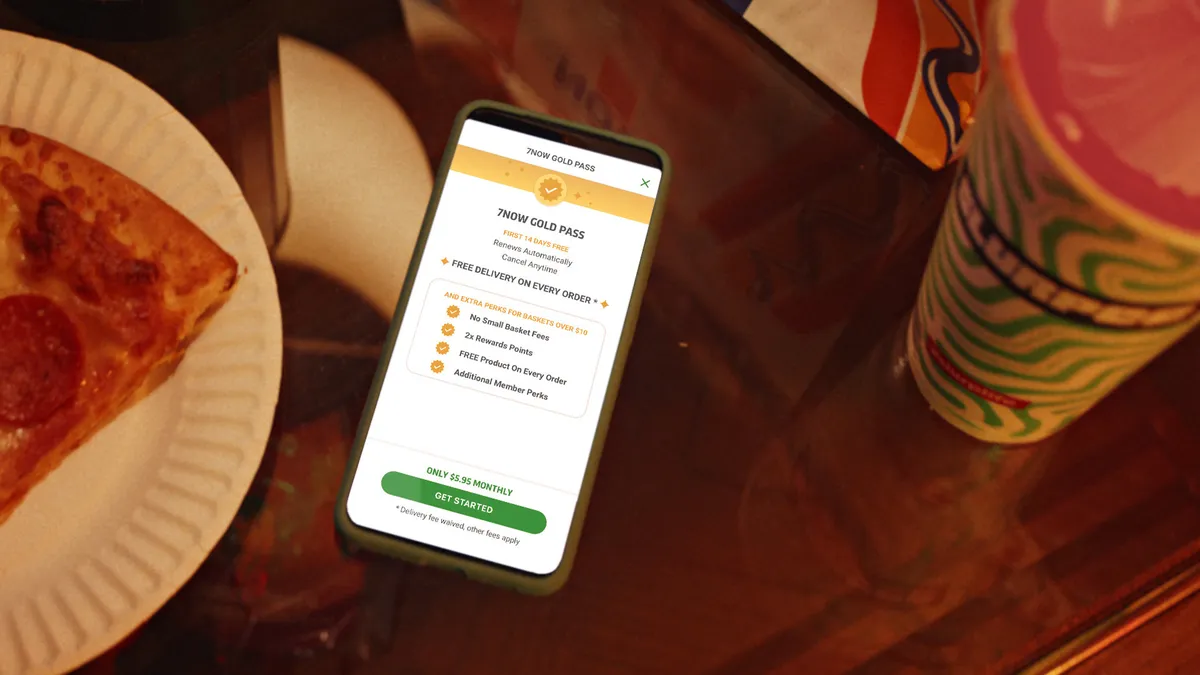

While grocery delivery is equally as competitive as restaurant delivery, Prevé said DoorDash’s edge comes from building a platform with millions of monthly users and 10 million DashPass members. DashPass, DoorDash’s $9.99 monthly subscription program, helps reduce delivery friction since it eliminates delivery fees, making customers more likely to try grocery delivery, she said. The other reason grocery has grown so quickly is DoorDash’s ability to offer multiple products to different types of customers.

DoorDash added Express Grocery in February with Albertsons to provide delivery within 30 minutes or less, Prevé said. It has also been providing ultrafast delivery within 10 to 15 minutes in New York City, specifically in Manhattan and Brooklyn.

Prevé said she’s most excited about DoubleDash, a feature which allows customers to order from a restaurant or other merchant and then tack on another item from a nearby merchant to be delivered by one courier.

DoubleDash came about as the company sought ways to expose its 25 million active monthly users to more of its selection, she said. The company started small with this product, initially launching in 2021 with a select group of merchants, including 7-Eleven, Walgreens and Wawa. Earlier this year, it expanded DoubleDash to allow consumers to add an alcohol order from a nearby liquor store.

“Even in a category like convenience where we have some long-established partners like Walgreens, we’re still innovating,” Prevé said. “We’re still launching new types of products that attract new customers and then we can deliver those new customers to our merchant partners in that vertical.”

How DoorDash is helping retailers build a delivery channel

DoorDash is only looking to enter businesses where it could be profitable, Prevé said. When it thinks about new verticals, a segment has to be feasible for its drivers and allow them to make money. It also has to help draw new customers to existing merchants like grocery stores, and satisfy the needs of its consumer base, Prevé said.

From there, DoorDash focuses on how to make the experience what all three parties need, she said. For DoorDash’s grocery and convenience store partners, 70% to 90% customers who shop on DoorDash’s platform are net new customers to those partners.

“When we see something like that, we really want to focus on it, and see how we can continue to develop that. And we know that we will eventually be profitable,” Prevé said.

Ensuring customer retention hinges on customer experience, which includes selection and quality of products.

“Did you get what you ordered? It sounds simple, but it's so important. And then did we deliver when we said we were going to deliver? At a high level, these things sound simple, but they actually take a lot of work and persistence and iteration to get just right,” Prevé said.

“I think what you'll see going forward is continued partnership, continued innovation and continued iteration on what has worked in all of our other verticals: selection, quality, speed, and customer happiness,” Prevé said.

For a convenience retailer like Walgreens, delivery has been an important way to reach more customers and increase awareness of self-branded products, Kruse said. Walgreens has also partnered with DoorDash for its DoubleDash offering, which has helped drive incremental sales and customer growth, Kruse said.

DoorDash’s speed to market also helped Walgreens launch alcohol delivery from 4,000 stores, she said.

“That’s another good example of our ability to win and collaborate quickly because it’s obviously very complex to do from a regulatory standpoint,” Kruse said. “As we think about heading into the holidays and last-minute entertaining needs, that’s been a good benefit to us.”

DoorDash has also allowed Walgreens to deliver on its own one-hour delivery promise. While it has other delivery partners, DoorDash is its biggest strategic partner for one-hour delivery, she said.

“[Our relationship] is very much how do we build something that is meaningful for our customers? How do we lean in together on that and really learn from one another? So there’s been a lot of really good learnings that we have shared back and forth [with DoorDash] in terms of what’s working, what’s not on each of our platforms,” Kruse said.