Dive Brief:

- Global trust in digital services declined across most sectors since last year, according to a Thales survey of over 14,000 consumers released Tuesday. Only insurance, banking and government saw trust increase or remain flat.

- When asked which sector consumers trusted with their personal data, not one garnered more than 50% of consumer trust.

- A grand majority (86%) of consumers expect some amount of data privacy rights with the companies they interact with online, but almost 20% say they have had their data exposed in the past year.

Dive Insight:

Consumers are skeptical of how brands use their data, and they’re willing to abandon brands if their trust is broken.

Concerns about privacy is one of the primary reasons trust has fallen, according to Haider Iqbal, director of identity and access management for Thales. “People are getting a lot more conscious about data privacy, how their data is being used, if their data is being used, are they being informed about it, or not,” he said.

Most consumers (82%) say they’ve stopped patronizing a brand because of how they perceive their data is being used, according to the survey. Almost two-thirds believe too much onus is put on the consumer instead of the business when it comes to data protection.

Some business leaders may think they’re doing a good job with data security, but the key word, Iqbal said, is "perceive."

“It's not just a matter of putting the right controls in place, but sometimes even explicitly showing the users that you care as well,” Iqbal said. “One of the things that we often observe, let's say with insurance companies or banks, is having the right kind of consent management capabilities or preference management capabilities for their consumers really helps. For example, me as a consumer, even if I've consented to sharing certain data, I should be able to go back and modify my consent as and when I require.”

Banking emerged as the most trusted sector for the second year in a row, with 44% of consumers saying they trust the industry with their personal data.

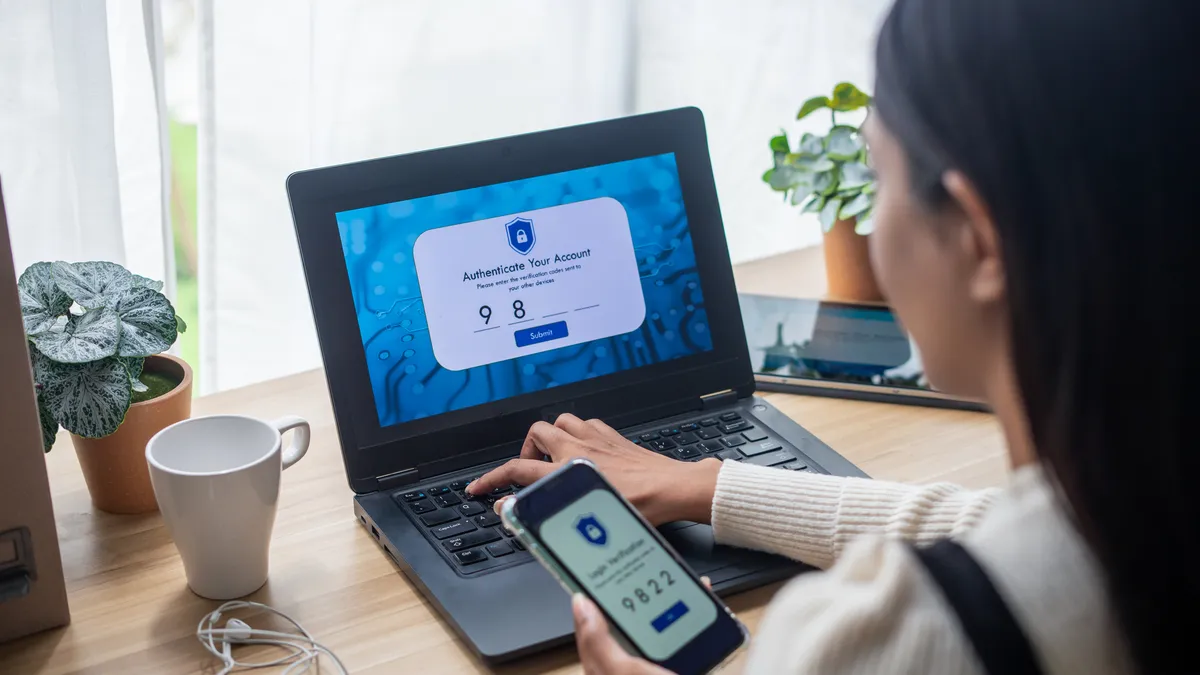

Iqbal attributes that to the heavy financial regulations banks face, which reassure customers, and their commitment to data protection through measures like multifactor authentication. Almost 9 in 10 consumers — 86% — say multifactor authentication is important, the survey found.

“The industry always seems to look down upon [MFA] as something that creates a lot more friction, for the consumers,” Iqbal said. But a little bit of friction can go a long way.