It’s hard to stand out in a field as crowded as the world of mobile apps. There are nearly one and a half million of them on the Apple App Store, according to Business of Apps.

While some c-stores are ahead of the curve, generally “convenience stores are lagging behind” other retail channels, said Gautham Vadakkepatt, associate professor of marketing at University of Central Florida’s college of business.

Jeffry Harrison, co-founder and president of c-store app company Rovertown, agreed.

He noted that companies spend a lot of money and time making sure their stores look good, are clean and have the right amenities and assortment. But they typically don’t put that same effort into apps. Sometimes they don’t even have a dedicated position overseeing their mobile efforts, delegating it to a category manager or someone else on the staff instead.

“Just put a little bit of investment timewise and moneywise into your [app] and you'd be surprised how [many] more repeat customers you get,” said Harrison.

Vadakkepatt said that determined retailers could quickly move from the back of the pack to the front, since they can learn from what other companies have been doing over the years in app development. It’s all about execution.

“You either build really deep relationships with the people who come to the stores and then use this as a communication tool,” said Vadakkepatt. Or else, they need to come up with an interesting way to add value to a customer’s day, he said.

Below are some of the ways experts expect c-store apps to grow and change over the next few years.

More unique apps

In the past, apps were limited by the complexity of building one.

“You had to either go get a prebuilt white label solution or spend a lot of money and time and go build a full-on custom approach,” said Frank Beard, head of marketing for Rovertown.

But as technology has advanced and app construction moves toward a platform approach, customers are going to want something that’s not only easy to use but more complex as well.

Part of this is due to the “multi-faceted” nature of many c-store sites, said Beard.

“Under that roof, you've got you'll retailing, you've got QSRs, you've got CPG retailing, you have car washes, you have delivery services, you have air pumps,” he said.

Customers will expect apps to include many if not all of those aspects, instead of a simplistic and cookie-cutter experience.

“Just put a little bit of investment timewise and moneywise into your [app] and you'd be surprised how [many] more repeat customers you get.”

Jeffry Harrison

CEO and co-founder of Rovertown

The industry should also see not only improved aesthetics, but more engaging design as it becomes easier and faster to tailor the experience and look for a specific chain or set of users. For example, Harrison said instead of an app featuring a regular coupon for 50 cents off a Snickers bar, the coupon image could slide down from the top of the app and be a little interactive.

When apps showcase a c-store’s personality, they can tap into the sort of brand loyalty that many chains, like Casey’s, Wawa or Kum & Go, are known for.

“It's like sports teams,” said Beard. “And there's really something there from a marketing perspective that can be leaned into in a big way.”

Greater personalization

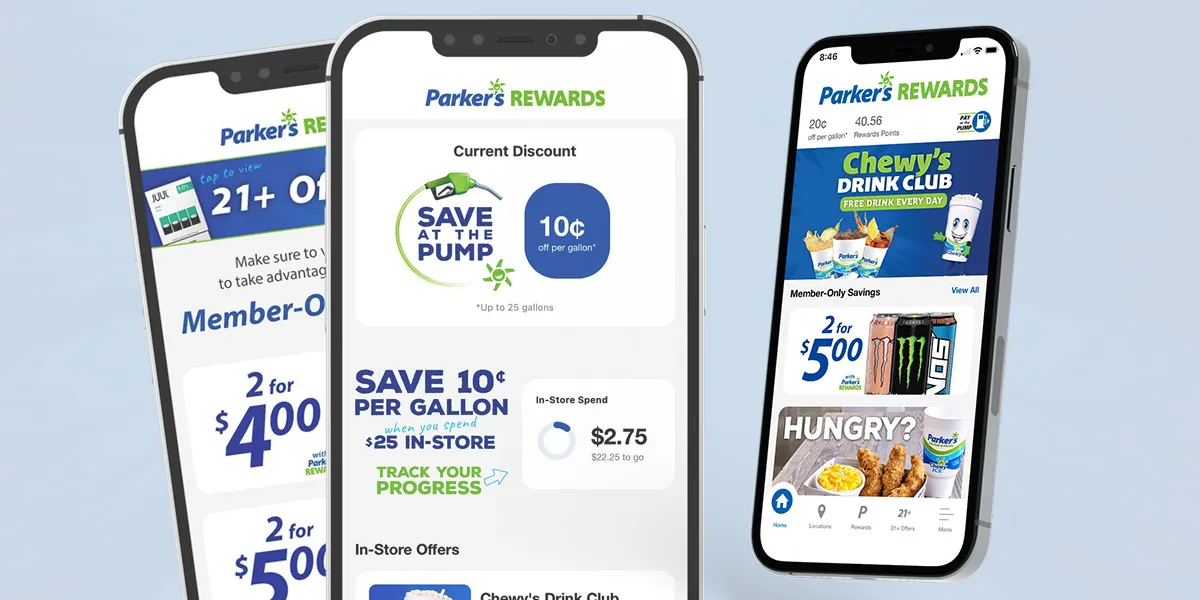

C-stores are already starting to lean into the benefits of personalization. Coen Markets updated its apps with more personalization options, and Parker’s announced it would be doing so in the near future.

Right now, that means companies are using data they gather about customers’ shopping and usage habits and segmenting them into smaller groups so they get better ads for them based on things like location or what brands and items they like to buy, said Matt Sargent, director of strategy analytics for Sargent Up North.

Greater personalization can further drive emotional connections between customers and retailers.

“When you think about Wawa in Philadelphia or you think about Casey's in Illinois or Iowa … those retailers have nurtured that connection,” said Sargent.

That relationship can be one of the greatest assets a retailer has, experts say, and retailers can leverage it to keep their mobile efforts top of mind among their audience.

“It's very hard to make a one-time sale but it's very easy to make a recurring sale to people that trust you and go to you,” said Harrison.

A determined company could eventually even get to truly personalized notifications, based not on segmentation but on the individual’s day-to-day actions, Sargent said, suggesting the app could not only show ads for a new location a specific customer visited, but also note trends or changes in locations or behavior.

“It doesn't have to be a promotion,” he said, noting that retailers could push welcome messages shoppers when they enter a new store or visit a location in a new state.

Balance between privacy and data

The tug-of-war between privacy and access is taking place in many facets of the digital world.

“There is growing resistance to sharing personal data, so maybe stores and companies will actually reduce the friction to sign [up],” said Vadakkepatt. “However, you need that information to actually personalize the content that you put forward.”

Currently, many companies require users to fully sign up before they can use any features of the app. That immediate friction could turn some users off.

“If you have an app where as soon as I open it up, you asked for my first name, my last name, my email address, my date of birth, my blood type and all those other things, I'm like, I don't know what the value is,” said Harrison. “Why am I trading this info?”

Beard suggested this tendency stems not just from many apps being very templated, but also from c-stores initially viewing apps as extensions of their loyalty programs. He said the industry could “shift away from this approach where you wrap an app around a loyalty program … to an app where a loyalty program is just one of several compelling features.”

With improvements in technology that allow for apps to be more customized, Harrison and Beard said they expect to see more apps offering features for more than just loyalty members — and not requiring a login for everything.

Improved communication

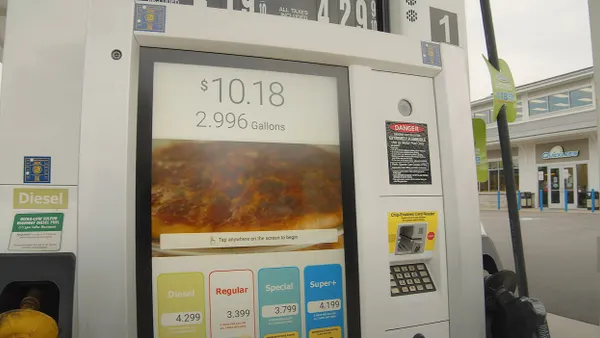

Apps could also make it easier to hear from customers — like when something in the store or at the pump doesn’t work right.

“What's the natural reaction?” Harrison said. “Go on Facebook and tag them and bash them right?”

Giving customers an easy way to flag things like dirty bathrooms or broken equipment gives them an outlet and enables the store to fix the problem more quickly — and without the negative review.

Apps could also give c-stores an easy way to talk with customers directly as the brand grows and changes.

“An example is, ‘Our next special flavor of the month is going to be choice one, two or three. What do you think it should be?’” Sargent said. “Or, ‘We're thinking about opening stores in new areas. Should we open in north Texas or Arkansas?’”

7-Eleven has a form of this with its Brainfreeze Collective, where members can answer polls, quizzes and open-ended questions about a variety of topics, from food preferences to holiday traditions.

That data can be important for more than just the c-stores themselves, Sargent noted. Retailers might find there are CPG companies “who will fund that and likely add promotions to that and will be hungry for the information.”

Gamification

Gaming is one of the most popular activities people do on their mobile phones. More than 20% of all apps on the Apple App Store are games, according to Business of Apps.

C-stores have adopted the idea. For instance, the TXB app allows users to spin a wheel for prizes, and a number of apps, like FastLane’s, offer mini racing games to earn rewards.

Vadakkeppatt noted that gamification helps in two ways: It makes the app stickier and it builds a sense of community.

“It is a way to nudge you to be consistently on the app,” he said.

That reinforcement to get recurring users can be vital. In the future, apps will push this even further.

“I think gamification is going to keep getting better,” Harrison said.

That includes making games more unique as well as thinking about the community a store is in. As an example, Harrison pointed to a game GoMart recently introduced called Cryptid Quest. Loyalty members can unlock cryptids — creatures from an urban legend — with purchases of certain items, with a bonus for unlocking all of them These cryptids include both well-known monsters like Bigfoot as well as ones more localized to GoMart’s West Virginia area, like the Flatwoods Monster, Mothman and the Ogua.

And it doesn’t have to be just video games or contacts. Just by evolving a loyalty program, companies can increase the gamification.

“A loyalty program is purely gamification,” said Vadakkepatt. “The more you use it, the more rewards you get, and the more you buy, right? That's gamification.”

Editor’s note: The original version of this story misstated Jeffry Harrison’s title. He is co-founder and president of Rovertown. The story has been updated.