LAS VEGAS — Cruise down California’s Pacific Coast Highway and you’ll see Tesla after Tesla zip by. In the Golden State, electric vehicles make up more than 17% of new car sales. The numbers are similar in British Columbia where one in five cars bought were electric this past quarter, Parkland CEO Doug Haugh said during a session Sunday at the NACS Show.

“This is now very real for us. That's an immeasurable number of customers for us to service. And what we also noticed was the few places that did have high-speed charging available had lines,” he said. “So it immediately changed from, ‘Hey, when are we going to work on this too? Are they going to show up?’ to ‘Hey, there are customers that have a need that we can fill’ and that made it very real for the strategy.”

But while Parkland has a strong c-store presence in British Columbia, it also has locations in North Dakota, where less than 1% of new car sales were EVs.

“The future has arrived, but it's not evenly distributed,” said Haugh.

So with vastly different markets, what should convenience store operators know about EV customers and how to capture them? And the bigger question on many retailers’ minds remains: Is it even worth the time yet to factor these consumers into their strategies?

Anila Siraj, managing director of alternative fuels for retail analytics company Kalibrate, says yes. “The key is really being prepared now,” she said during a separate panel on EV economics. “I like to use this Ernest Hemingway quote, which says it happened ‘gradually, then suddenly.’”

Across several panel discussions on EVs at NACS, the opinions were similar: You don’t need to go all in immediately, but you need to start learning now.

The changing face of the EV consumer

The traditional, fuel-pumping customer is a known quantity to retailers. The segment is a lot more mature, drawing in people of many ages, incomes and genders, Siraj said.

But the EV consumer is in the early phase — “innovators” as Siraj called them. Think the first person in line for the latest iPhone. “They want to have the latest and greatest items and they really know how to use it. That's where we are right now,” she said.

Jacob Maass, a commercial fuels manager at Kum & Go who spoke at the same session as Siraj, agreed. The Midwestern chain currently has 35 charging stations and expects 150,000 charging sessions this year, he said.

“What we learned about our customers is that they really know their stuff,” he said, adding that these people know the ins and outs of how their cars operate, from battery capacity to charging power output.

The demographic is typically much older, very affluent, tech savvy, convenience driven and focused on health and wellness, said Siraj. The data shows they have a clearer idea of what they want and what brands they want to purchase from.

But the demographic is expanding. “In the past we talked about the EV consumer being a middle-aged man who had over $100,000 in income,” said Siraj. “We did some research recently, and over the last two years, we've seen that they've gone from married to single, older to younger, and average income has dropped by about 11%. So we know that that profile is changing and it will continue to change as we move through the adoption.”

Targeting the right market and consumers with EV charging

With businesses beyond the convenience store space setting up chargers, retailers have stiff competition. Analyzing their local consumers and market could help c-stores capitalize on the EV opportunity and differentiate themselves.

Vancouver, for instance, has a lot of high rises and surface parking, but fewer single-family homes, said Parkland’s Haugh. “We think that there's an obvious market for us to serve those garage orphans with a great offering and meet their needs.”

Kum & Go has a similar strategy, targeting areas where apartments and townhouses are the norm. The company also looks at places that do not have the electrical capacity to be able to charge EVs in every single garage in the neighborhood when adoption rates increase, said Maass.

But what both really zero in on are the road trippers, and they’re channeling a lot of their energy along the fuel corridor. “The more widespread opportunity that we see is servicing travelers, not commuters,” said Haugh. “There's a clear opportunity and a clear need to provide the services to these travelers.”

Capturing their dollars

Setting up a plug is just the first step in luring EV consumers to a store. Traditional c-store customers are in and out within a few minutes, but EV users often have to stick around for 30, and up to 90, minutes to recharge.

If operators want repeat customers, there is a lot of data they should analyze, panelists said. What are they buying? How often are they charging and how long does it take? How many kilowatts per hour are getting charged? How long do the charges last? Where do its consumers live and work?

Understanding their habits will help c-stores tailor their offerings to the local shopper because amenities will be key, Siraj said.

At Parkland, Haugh said the company ensures that a location has multiple chargers. “You might think, well, we only have a few customers in these markets. Let's just put in one. Our recommendation is that's a bad idea,” he said. That’s because when customers see online that a location only has a single charging station, they’re likely to look for another one to avoid driving across town or taking the exit only to find that the lone charger is occupied.

“We think even in the early stages of adoption, it's really important to go all in and invest in multiple outlets,” Haugh said.

He also emphasized a simple but valuable amenity: clean restrooms. While it’s always a part of the store experience, with more shoppers spending longer amounts of time inside drinking coffee and eating, it becomes even more important. “Sizing, cleaning them, putting them on the right cycle and making sure that your commitment to that experience is flawless is a really important fundamental,” he said.

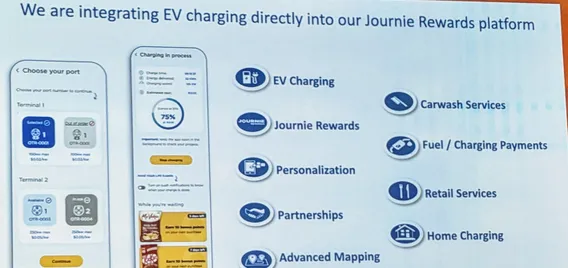

Parkland also invested heavily in its digital experience as it increased its EV capabilities. “The product is digital, literally electricity, right?” Haugh said.

The c-store chain integrated its chargers directly to its Journie Rewards loyalty program app, where users get personalized promotions for the in-store experience when they start charging. The mobile app also provides ongoing updates, in case their car doesn’t, so they know when their vehicle is fully charged. This helps alleviate the problem of cars parking for too long as other EV consumers wait for stations.

For Kum & Go, speed is key to drawing more consumers, Maass said. The company will no longer use Level 2 chargers and aims to get people on and off the lot in about 30 minutes. “Fifteen would make it even better,” he said.

That’s not to say they don’t lean into the amenities inside the store, offering WiFi, elevating their foodservice with items like grab-and-go burritos and having plenty of seating. Maass also said EV customers will need a canopy over their chargers to be protected from rain or snow as they wait.

As adoption increases, however, Siraj warned customers will get pickier about the overall experience, so learning more about consumer behavior will be critical.

“One of the things that you can get through data is really understanding that customer. Where did they go before they went to your store and after your store? So then you can start to understand what they really want to do. … How can you bring that [information] into your location to differentiate it?” said Siraj. “Be the one-stop [shop] for them so that they choose you over the competition.”