Candy sales in convenience stores are booming, according to market research company Circana. In 2023, convenience stores generated $8.5 billion in candy, mint and gum sales, up 11.9% over 2022, according to the NCA.

However, these sales increases are being driven by higher prices, while unit sales and volumes are in decline.

"The price point compared to other snacks is affordable, but you've got a perfect storm — prices are high, cocoa is high, so prices are a little elevated and consumers are not walking away, they're just buying less," said Dan Sadler, principal with Chicago-based Circana.

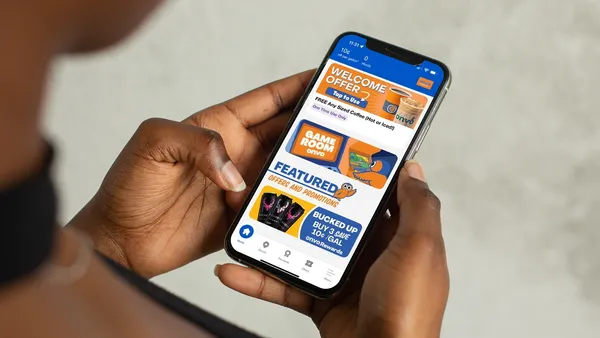

As customers trade down, private label candy has emerged as a winner. A leader in this area is 7-Eleven, which has an extensive offering including gummies and jelly beans.

According to the National Confectioners Association, store-brand chocolate sales grew 12.6% in 2023, but were still only 2.2% of chocolate unit sales. Store brand non-chocolate sweets, meanwhile, make up about 5.4% of unit sales

Candy sales remain fairly strong because consumers consider chocolate and other sweets an affordable treat. It's tied to their emotional well-being, seen as a reward but also a pick-me-up, Sadler pointed out. Eighty six percent of consumers say they are OK with treating themselves with candy — on average, twice or three times a week, according to the NCA.

"C-stores have been a particularly bright spot for confectionery companies, as younger consumers are drawn to the unique, fun options offered by the segment," said Mike Kostyo, vice president with Menu Matters, a Vermont-based food consulting firm. "Candy is often a poster child for affordable indulgence."

Non-chocolate sales are going strong

While dollar sales of chocolate were up in 2023, according to Circana, unit and volume sales were down by 5.4% and 4.4%, respectively. These drops were due to households buying chocolate less frequently and purchasing smaller amounts, according to the NCA.

Non-chocolate candy is filling the gap left in the candy market by chocolate. Non-chocolate candy sales were almost $12 billion in 2023, up 12.2% over the previous year, the NCA said. Chocolate, meanwhile, earned $19.3 billion.

There's a lot of variety in non-chocolate candy, from gummies to lollipops, and retailers last year reported that they'd expanded their assortment, with the average items per store up by 7.4%, says the NCA. The biggest increase in sales came from novelty candy (up 49%) but hard sugar and rolls sales were up 10.7% and chewy candy by 9.5%. Mint sales jumped 13.9%.

Sour candy is popular with younger generations, said Anne-Marie Roerink, principal, 210 Analytics, as are licorice and gummies that change flavors as you eat them. "There's been a lot of innovation in textures, flavors, shapes, and that's driving a lot of engagement with younger generations," she said.

Kostyo pointed to the popularity of freeze-dried candies and "sweet-heat" products with spicy profiles as well.

Natural and ‘free from’ choices are gaining traction

Even though many consumers eat candy as a treat, some are also looking for healthier sweets, or those that have positive attributes. Overall sales of sugar-free non-chocolate candy, for example, were up 14.4% in 2023, according to the NCA.

But “healthy” means different things to different people. The leading health claim Americans look for from candy is all-natural, meaning it contains no artificial ingredients. That’s followed by organic ingredients. Shoppers also are looking for lower-sugar, sugar-free, gluten-free and vegan options. These claims are especially important to Millennial and Gen Z consumers, according to the NCA.

Other increasingly important traits for candy are: palm oil-free; helps with energy/alertness; lactose-free; helps with oral health; low-, reduced- or no-cholesterol, according to Innova Market Insights, a global market researcher.

Nostalgia versus innovation

Some differences in candy trends depend on peoples’ age. Baby Boomers in particular, but also Gen Xers, are looking for familiar products like M&Ms and Starburst. Younger consumers, meanwhile, are looking for innovation in some of these time-honored segments, or “newstalgia,” which according to Suzy Badaracco, president of Culinary Tides, picks up "where nostalgia left off, merging old products with new directions."

Candy is one of the most innovative categories in retail, said Roerink. In other categories, 1% to 2% of sales come from new items, but for candy it is 5% to 6%. "It's for the younger shopper who likes to explore,” Roerink said. “It's also that Instagram and TikTok moment to share with others."

Two big success stories are Nerds gummy clusters and Ring Pops, said Sadler, who's also seeing growth in liquid-type candy or squeezable gels.

MrBeast, the brand run by the popular YouTube star, also excels with innovation.

"Within candy, consumers are willing to try something different — it's sensory, it's experiential, and there's a lot of ideas that could be presented to consumers that would resonate," Sadler pointed out.

Smaller companies and brands innovate and grow

The big confectionery companies still dominate the candy market, said Sadler, with four or five firms claiming a 75% share of the market while the mid-size candy manufacturers hold another 10% to 15%. That leaves only 10% to 15% for niche companies that need "to have a point of differentiation to have some success," he said.

But according to Innova, smaller companies have been gradually taking a larger share of the market in the past three years. Last year 64% of new product launches in candy came from smaller companies, up from 55% in 2021. On the flip side, 22% of new products came from mainstream giants, down from 28% two years earlier.

While the very largest candy brands continue to grow, innovative brands a little further down the rankings are increasing their share, said Jordan Mann, senior vice president of corporate strategy, capital markets and investor relations for convenience retailer Arko Corp.

"In our experience, these brands reflect the growth in the non-chocolate and health, energy, and protein segments," Mann said.

Editor’s note: This story was updated to correct the spelling of Dan Sadler’s name in some instances and correct the home state of Menu Matters to Vermont.