Americans’ worries about food and beverage inflation are still impacting c-stores halfway through the year, and experts predict continued price sensitivity through the remainder of 2023.

At the same time, c-stores have some inherent advantages versus other channels that may boost sales of certain items, such as beer, liquor and energy or sports drinks, experts say.

Overall c-store sales rose 5.5% for the 13 weeks ending June 18, compared to the same quarter in 2022, but units fell 0.5% due to an average 6.2% spike in prices for the quarter, according to Circana OmniMarket Total Store View data.

While overall inflation is declining somewhat — food-at-home prices rose 5.8% year over year in May, down from a 7.1% hike in April — and fuel prices specifically have dropped since the start of this year, gas prices are still impacting c-store customer behavior, according to Erin Brucks, director of marketing for c-store technology solutions provider Skupos in San Francisco, California.

In June, 73% of consumers said rising prices on essential goods and services is their primary economic concern (versus 76% in May), according to research firm Numerator, followed by 62% who said rising gas/fuel inflation was their main concern, compared to 65% in May.

As a result of the higher fuel prices, c-stores are seeing fewer trips inside the store and smaller basket sizes. C-stores had a 1.1% drop in basket sizes in the first quarter of this year versus the first quarter of 2022, according to Skupos. At the same time, with price increases, basket revenue grew 4.4%.

The U.S. C-Store Landscape Q1 2023 report from Circana also found that, while the surge in the cost of items in c-stores slowed down for the first time in almost two years, consumers remain highly price sensitive after more than a year of record inflation rates.

Overall, 73% of Americans say inflation is impacting their purchases, while 79% of that group say higher food costs are impacting them the most, according to recent Circana data.

“When everything around us gets more expensive, [consumers] prioritize food,” said Darren Seifer, food and beverage industry analyst for Circana.

As a result of price sensitivity, Americans are trading down somewhat and switching to private label, according to Seifer. Private-label sales grew 7% in the first quarter of 2023, but that lagged the growth among national brands for the same three months.

More than three quarters of those polled by Circana say they plan to buy more value brands in the next six months.

Top areas of growth for c-stores

Despite inflation, convenience stores have the advantage of saving Americans time while they pick up food and beverages.

Because prices are up pretty much everywhere, consumers are less likely to shop around for a deal on their favorite brand of drink or snack, as opposed to something like a generic bottle of water, which can be found elsewhere cheaper, according to Brucks.

“While the average cost per unit at convenience stores tends to be higher than that at grocery stores, shoppers enjoy having quick access and buying just one or two items,” said Anne-Marie Roerink, principal of fresh grocery consulting firm 210 Analytics.

Roernik also explained that c-stores have the advantage over other channels in appealing to younger shoppers. “Gen Z and Millennials are far more spontaneous in their meal decisions and snacking occasions throughout the day and convenience stores have done a tremendous job in creating solutions for all,” Roerink said.

Certain categories, including beer, liquor, candy, snacks, and energy and sports drinks are expected to continue to perform well in c-stores, even if inflation continues to rise in those segments, experts say.

In some categories, such as sports drinks and sweet snacks, consumers are trading up across all types of retailers, Seifer said. Overall dollar share of sports drinks increased 3 percentage points for multi-outlet retailers, which includes grocery, c-store, mass merchandisers, drug stores and other retailers, for the 13 weeks ending May 14, according to Circana.

In c-stores, sales of energy drinks jumped 16.6% for the 13 weeks ending June 18, Circana found, and units climbed 8.4% as well, despite a 7.5% price hike.

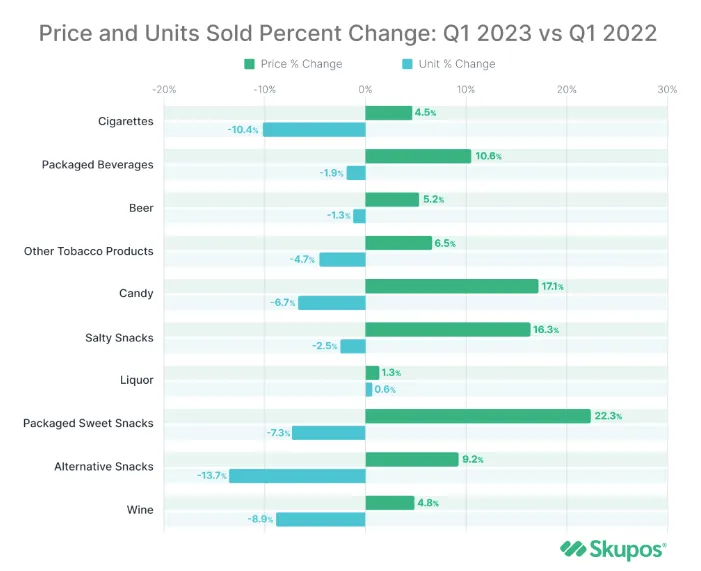

While liquor prices rose 1.3% in the first quarter of 2023, units also grew 0.6%. Beer prices soared 5.2%, and units fell by 1.3%, according to Skupos.

“Most bars and restaurants have reacted to rising prices by raising their own and throughout that, at-home consumption of alcohol has remained strong,” Brucks said. The pandemic in particular led more people to consume alcohol at home, she noted.

Also, thanks to new ready-to-drink cocktails, seltzers and craft offerings, c-stores present customers with more options, according to Brucks.

C-stores are also competing better on price than QSRs, analysts said. “That’s an important thing for c-stores, because foodservice is a fair amount of their business,” Seifer said.

Total foodservice sales soared 14.3% in 2022, according to data from the 2022 NACS State of the Industry survey.

C-stores have become particularly adept at offering competitive breakfast foods. “Compared to a year or two ago, more people are commuting. C-stores can provide a meal at a lower check point than foodservice — including breakfast sandwiches and other sandwiches,” Seifer said.

Strategies to boost sales during high inflation

To appeal to inflation-weary customers, c-stores should continue to offer more value, according to Seifer.

“To put additional items in the cart, they need to feel at some point they are saving money,” he said. “So, if they are buying a sandwich, [the] shopper should be encouraged to buy chips or something else as part of a combo deal,” Seifer said.

C-stores have become adept at bundling, cross-merchandising and encouraging customers toward “buying for now and buying for later,” according to Roerink.

“Shoppers enjoy having quick access and buying just one or two items."

Anne-Marie Roerink

Principal of fresh grocery consulting firm 210 Analytics

Discounts and promotions are driving sales in this economy, according to Brucks. “Participation in any brand-funded promotions that their stores are eligible for can help in this environment. In order for programs to be successful, you must merchandise them as much as possible,” she said.

Stores that display proper signage see promotions that are 33% more successful than stores that do not merchandise properly, according to Skupos.

Since time is a challenge for consumers and provides value to their lives, c-stores can also emphasize that value proposition.

“They are trying to get out of the door quickly … maybe they are grabbing a coffee on the road or something they can add to their meal on the way home,” Seifer said. “Show consumers how they can save time or money and they will respond to that.”

Economic outlook for the remainder of 2023

Despite a slowdown in food and beverage inflation rates, c-store customers are going to remain price sensitive through the remainder of this year, according to analysts.

“Every time consumers go to the store [for both food and general merchandise purchases such as clothing and video games], they see higher and higher prices and it causes anxiety,” Seifer said. “On average, since 2019, prices [of all goods] are up 30%. That’s still a tough pill for consumers to swallow, even if price to continue to decrease.”

Sixty-six percent of consumers believe the U.S. is in an economic recession, according to Numerator, and 72% think inflation will increase in the next few months.

There could be a decline in inflationary pressures, according to trends in the USDA Economic Research Service, Brucks said. Plus, the Federal Reserve’s decision to “’pump the brakes’ on rate hikes in the latest meeting appears to support a mild cooling of the economy.”

“But most experts agree that this is a tenuous halt on rate increases, and inflationary pressures may tick up again as we move through the year, forcing the Fed’s hand,” Brucks added.