Innovative private label products should continue to roll out across large and small c-store retailers this year as operators seek to offer customers value options.

Experts say retailers can use fun flavors in energy drinks, candy, savory snacks and other SKUs, along with alcohol collaborations and non-food offerings, to stand out and draw shoppers in.

“Consumer perception and trust in private brands has grown and retailers are doubling down on brand-building, premiumization, and innovation,” said Sally Lyons Wyatt, global EVP & chief advisor with Circana’s CPG and foodservice insights division.

Private label is a relatively small subset of overall c-store products, making up about a 4% unit share, per Circana, but sees strength in specific areas.

“We’ve seen PL growth in categories throughout the store at c-stores, including confections, non-alcohol beverages, snacks and much more,” said Peggy Davies, president of the Private Label Manufacturers Association, adding that these items are “a key growth driver for convenience stores.”

In a reflection of this growing trend, PLMA will feature a panel discussion on private label for c-stores at its 2025 Annual Meeting & Leadership Conference in April.

Some c-stores well-known for their private label offerings are Buc-ee’s, Casey’s General Stores and 7-Eleven.

The latter released nearly 140 PL items in the first three quarters of fiscal year 2025, which started on March 1, 2024. Casey’s, meanwhile, already carries more than 300 different private label items.

It’s not just the bigger players though. Smaller, regional operators are also testing the waters.

“[Private label] sales have surged as guests seek unique, high-quality products they can’t find anywhere else,” said Andy Strom, chief experience officer for Wally’s, an independent that operates large stores similar to Buc-ee’s. He noted that Wally’s aims for “fun packaging, exclusive flavors and better value than national brands.”

While many c-store chains are growing their store-brand selection, actual sales and volume fell in the last year, Lyons Wyatt said. And while private label snacks, carbonated soft drinks and other popular categories are growing in most other major retailer types, c-stores are not seeing the same growth, she noted.

This decline mirrored the year-over-year drop in c-stores’ overall sales in 2024, largely due to strong sales in 2023 and lower foot traffic, Lyons Wyatt explained. Plus, the rising prices of food-away-from home deterred some consumers from buying ready-to-eat meals from c-stores.

To regain momentum, many c-store operators are reverting to more branded products by prioritizing the fastest-moving goods, Lyons Wyatt said. ”Finding the right balance of private brands and name brands will be key to bringing in more foot traffic,” Lyons Wyatt noted.

Beverages, snacks lead private label rollouts

Private label juices and refrigerated beverages gained unit share at c-stores last year, according to Circana. Retailers have taken advantage of that strength to innovate in a number of ways.

Over the past year, 7-Eleven has added a new energy beverage, 7-Select Fusion Energy, and a new premium hydration beverage, 7-Select Rehydrate, along with a line of Prosecco wines. It also expanded its juice options and debuted sparkling iced teas.

Wally’s introduced a new lemon lime flavor in its Fizzo sparkling water line last year that is performing well, Strom said.

Davies said exclusive beer collaborations with local brewers are also on the rise.

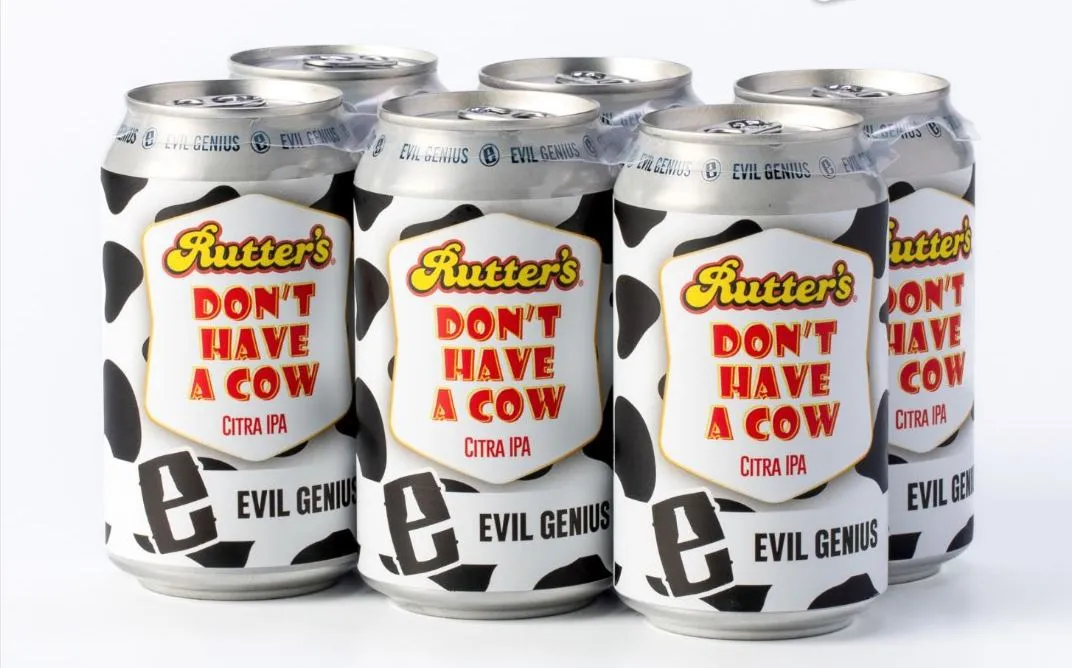

In January, Stewart’s Shops partnered with Paradox Brewery to revive its Mountain Brew beer. Last fall, Rutter’s teamed with Rusty Rail Brewing Company for its Haunted Harvest Pumpkin Spice Ale and in spring partnered with Evil Genius Beer Company on its Don’t Have a Cow beer.

Fun candy and snack flavors have also been a highlight of recent c-store private label launches. For instance, 7-Eleven released Slurpee-flavored gummies at the start of this year.

Kent Kwik rolled out new trail mixes and nuts with unique flavors such as cran-slam, sweet energy and butter toffee.

Wally’s is finding strength in all three areas. Fizzo and Wally’s Light Lager are among its most popular private label products, along with chips, cotton candy, animal crackers and chips in flavors like Campfire BBQ, Chili Cheese Hot Dog and Spicy Pepperjack, according to Strom.

“We carefully select flavors through extensive sampling, testing, and identifying what resonates best with our guests,” Strom said.

Apparel, travel gear lead non-food products

Apparel, travel gear and other non-food PL items are also becoming more common at c-stores.

Love’s Travel Stops & Country Stores’ Traverse Travel Gear line, launched last fall, features a mix of road trip essentials and comfort items. Products include a neck pillow and two different blankets.

Love’s, which sports more than 400 private label products, said it plans to roll out more products in that line this year, including a 3-in-1 backpack as well as the Traverse Pro Series, which will include tactical flashlights and cooling gel seat cushions.

Love’s travel pillow won one of PLMA’s 2024 Salute to Excellence awards. 7-Eleven also won for its 24-7 Life by 7-Eleven 100% Mesquite Charcoal Briquets, 7-Select Rehydrate fruit punch sports drink and 7-Select Fruit Squeeze pouches.

TXB, which has numerous food and beverage private label items, expanded into apparel in late 2023 with shirts and hats featuring the phrase “Cluck Yeah!”

What the future holds

After years of growth, private label sales are expected to continue increasing in the months ahead, particularly due to consumers’ inflation and economic concerns.

Roughly 41% of consumers surveyed buy private label products to save money, according to Numerator, and 46% say they will purchase more store brands this year, according to AlixPartners’ Grocery Shopper Perspectives report.

Wally’s executives also predict private label sales will continue their upward trend this year. As such, the team is “constantly working on expanding our PL offerings to keep things fresh for our guests and maintain a better, value alternative,” Strom said.

Select c-store retailers will make their way into new categories, but not in the short-term, Lyons Wyatt predicted.

"Longer term, I expect to see [private label] options expand across a large portion of the store at many c-store chains — especially those with strong loyal followings."