Quick service restaurants have come under fire recently as their prices surged. This opens the door for c-store chains to take advantage and further grow foodservice sales — if they can make sure customers know about the myriad ways they offer value, experts say.

Many major QSR chains raised their prices last year. After consumer backlash, including media attention on a McDonald’s charging nearly $18 for a Big Mac meal, CEO Chris Kempczinski said the restaurant chain will focus on affordability this year.

QSRs like McDonald’s may face backlash for these rising prices, especially on social media, acknowledged Claire Conaghan, associate director of publications at Datassential. However, consumers’ overall perception in Datassential’s Brand Performance Tool as of December 2023 is that McDonald’s is among the top limited service chains — including QSRs and fast-casual — for having a “best in class” or “above average” value/dollar meal.

“Convenience stores are doing a good job in providing a variety of price points, from a cup of soup for just a few bucks to great value on a full pizza or party sub.”

Anne-Marie Roerink

Principal of Lakeland, Florida-based consulting firm 210 Analytic

“Consumers may not see them as top for value … or highest affordability — that honor belongs to large pizza players — but they know that if they need an inexpensive item, there are options there that will work,” Conaghan said.

In January, Taco Bell rolled out a refresh of its value offerings featuring six new menu items and four “fan favorites” for $3 or less each.

Nearly half of restaurant operators plan to include more special offers on their menus this year, while 20% are adding more affordable menu options according to a Popmenu survey, sister publication Restaurant Dive reported.

C-stores are already known for value

C-store operators have been providing value meal deals and other specials and discounts for years — often boasting more affordable meals than QSRs, experts say. They also provide value in more creative ways than just price.

C-stores and limited-service restaurants perform almost identically in Datassential's Brand Performance Tool, which features consumer ratings for restaurant, c-stores and retail chains. On average 46% of consumers believe c-store brands overall are “best in class” or “above average” on value for the dollar and on average across all limited service is 46.7%, Conaghan said.

“Convenience stores are doing a good job in providing a variety of price points, from a cup of soup for just a few bucks to great value on a full pizza or party sub,” said Anne-Marie Roerink, principal of Lakeland, Florida-based consulting firm 210 Analytics. “As such, individual meals are likely on par with QSRs but convenience stores are able to bring good price points for larger parties and family meals.”

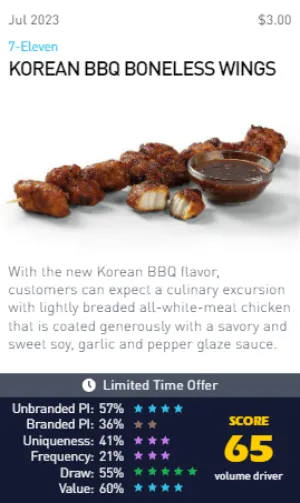

QuickChek’s Homestyle Breakfast Burrito for $4.19, 7-Eleven’s Korean BBQ boneless wings for $3 and Casey’s S’Mores cookie for $1.49 performed well on value and other measurements in Datassential’s Launches & Ratings platform.

“Across both QSR and c-store segments each chain has strengths, and if they focus on those strengths, value can be derived from them, whether that strength is being the only gig in some towns (in the case of some c-store or QSR brands) or offering a very craveable product,” Conaghan added.

Value doesn’t just mean cheap

Value at c-stores is not always a matter of offering the lowest prices. Many of the highly rated c-store chains in Datassential’s Brand Performance Tool — such as Kwik Trip, Sheetz, Wawa and Cumberland Farms — sport “innovative menus, demonstrating that value isn't always a pure price point battle,” Conaghan said.

For example, Jacksons Food Stores recently partnered with Darigold on a sweepstakes where winning customers got a year’s worth of milk for free. Consumers enter the sweepstakes when they buy one gallon of Darigold milk.

Roerink also stressed that value is about much more than price: “It’s the combination of price and quality, convenience, taste and more,” she said.

C-stores offer easy parking and allow customers to take care of multiple chores in one trip — an advantage versus many QSRs, Roerink said.

“We are seeing guests recognize both the value and convenience that we’re providing in our stores that compete with QSRs in price, quality (and taste!),” said Kevin Smartt, CEO of Spicewood, Texas-based TXB. Plus, with TXB’s loyalty program, customers earn points on fuel and purchases made in-store, Smartt added.

While TXB has had to increase some food and beverage prices due to higher overall costs, the company has “ tried to counter that by offering stronger discounts when using our loyalty program,” Smartt said. “We only consider retail increases when we’re faced with cost increases.”

Additionally, TXB stays focused on making sure it keeps the quality of its food high, according to Smartt, who said, “we want our guests to be confident that when they step into a TXB, no matter what they order, they’re getting something fresh.”

At the same time, TXB is aware of offering customers affordable snacks and meals. Last year, it began offering two Family Take Home Meals for $19.99.

Its chicken tender meal includes 10 tenders and two 16-ounce sides. Its tamale meal deal includes a dozen tamales, Spanish rice and refried beans.

Getting loyalty programs involved

TXB isn’t alone in using its loyalty program to offer deeper discounts. A number of other industry heavyweights have also taken this approach, including 7-Eleven and GPM Investments, the c-store arm of Arko.

7-Eleven offered several meal specials at all of its banners during Super Bowl weekend, offering low-priced pizza and wings alone or in combination.

GPM introduced a “premium inflation busting take-to-bake whole pizza pie” in more than 1,000 stores for $4.99 for enrolled fas Rewards loyalty members, said Michael Bloom, executive vice president and chief merchandising and marketing officer of GPM. The pizza is $7.99 for customers who aren’t part of fas Rewards.

This pizza — available in cheese or pepperoni — are also available hot and ready to eat in around 225 of those stores, where loyalty members can get a whole pie for $4.99 or a quarter of a pie for $1.49.

“We understand that our customers are concerned by rising food prices in all aspects of their daily lives after recent periods of record inflation rates,” Bloom said. The pizza deal was in development for over a year and is an add-on “to the value we try to offer our customers every day,” according to Bloom.

“Once you build up a reputation in these types of extreme value offerings, people will start to check their apps to see what’s on sale this week and you turn into a destination,” Roerink added.