Dive Brief:

- Convenience store sales hit a record $906 billion in 2022, according to a Wednesday report from NACS.

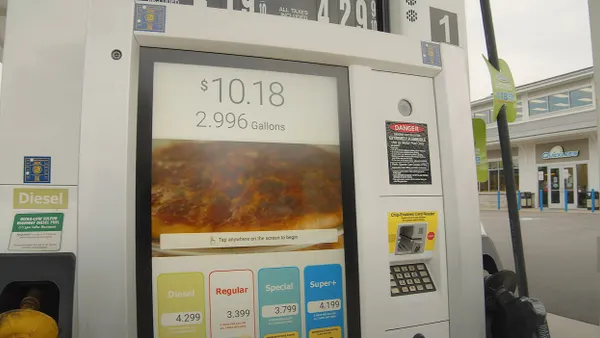

- In-store revenue rose 9% to $303 billion, making up roughly a third of sales on the back of double-digit growth from packaged beverages, other tobacco products, salty snacks, candy and sweet packaged snacks. Fuel sales rose 41% to $603 billion.

- Foodservice also made a splash, accounting for roughly a quarter of in-store sales each month, and over a third of the in-store gross margin.

Dive Insight:

As c-stores continue enhancing their foodservice offerings, that work is bearing fruit. Prepared food made up about two-thirds of that segment’s sales. Below that, commissary food made up 9.5% of sales, hot dispensed beverages made up 9.2%, cold dispensed at 8% and frozen dispensed at 6%.

C-store sales by year

This matches with Circana data showing that convenience retailers stand behind only QSRs in the commercial foodservice market. C-stores had 17% market share, and grew by 2% year over year.

High prices also drove much of the gain, with NACS citing fuel prices in the forecourt and inflation inside the store as major contributors to the growth. The merchandise consumer price index rose about 8% in 2022, while the foodservice CPI gained almost 10%.

The growing number of c-stores also helped improve overall sales. The store total grew 1.5% in 2022, reversing four years of declines and led by a boost in the number of independent operators.

The average basket came in at $7.52, up around 5%.

On the flip side, expenses were also higher than ever. Full-time wages grew 9.1% and part-time wages grew 12.6% to north of $14 per hour for both categories. Swipe fees were up nearly 40% from 2021 as well, costing $19.5 billion.

Overall, convenience stores accounted for 2.44 million U.S. jobs, according to the report.