The beer category has been plagued by price increases since the start of the COVID-19 pandemic, dampening sales. And while inflation is not as steep as it once was, sales have declined as prices remain high and customers feel pressure on their wallets.

Overall c-store beer sales declined 2.5% for the 13 weeks ending Aug. 11, while case sales decreased 5.1%, according to Circana.

However, when looking at the full year ending Aug. 11, sales rose 0.5% to nearly $25.7 billion, while case sales declined 2.6%.

Beer has “taken too much price and is really struggling with that,” said Jim Watson, executive director of beverages research at financial services company Rabobank. In late 2022 and early 2023, price increases due to supply chain problems began, he noted. Even though price hikes are not as steep currently, beer is more expensive than wine and spirits on average and has lost share to both.

Over the past 15 years, beer has dropped from around 50% of the share of consumers’ alcohol spending to 35% in 2023, according to market research firm Euromonitor, Watson noted.

Beer sales have been further impacted recently by industry leader Anheuser-Busch’s Bud Light losing share last year after a boycott over the company’s collaboration with transgender influencer Dylan Mulvaney.

C-stores are bearing the brunt of beer’s decline in popularity because the “beer industry loves c-store sales, and foot traffic is down in c-stores,” Watson noted.

People are still drinking beer; they are just drinking it along with many other things.”

Lester Jones

Chief economist for the National Beverage Wholesalers Association

Despite the bleak news, c-store operators and industry experts remain optimistic about growth in the category.

“While I can’t speak for other convenience retailers, category sales at Rutter’s are growing,” said Adam Long, senior category manager for York, Pennsylvania-based Rutter’s. He added, “The category commands space allocation due to high demand from our loyal customer base.”

The foodservice-forward chain features as many as 475 beer SKUs in some of its stores, placed in large beer caves “so we can offer the largest variety of options for all consumers,” Long said.

C-stores’ share of the overall beer market is “still relatively healthy” and beer continues to be popular in the U.S., said Lester Jones, chief economist for the National Beverage Wholesalers Association.

The overall liquid refreshment market has expanded rapidly in recent years, giving consumers more options. “People are still drinking beer; they are just drinking it along with many other things,” Jones said.

Additionally, the NBWA’s Beer Purchasers’ Index (BPI) for July 2024 showed an increase in year-over-year beer ordering volumes for the fifth straight month — the first streak like that since 2021, the organization said. The number of retail establishments that sell beer is growing, giving consumers more choices, according to Jones, but also putting pressure on c-stores to make the sale.

Flavored malt beverages sales soaring

Flavored malt beverages (FMBs), a sub-segment of the overall beer category, are having a heyday. C-store FMB sales for the year ending Aug. 11 shot up 12% to nearly $3.1 billion while case sales rose 10%. Sales also grew 5.3% in all outlets for the two weeks ending June 15, according to Goldman Sachs’ Americas Beverage Report.

Hard tea products continued their incredible growth, ballooning 17% for the quarter ended Aug. 24, according to Goldman Sachs data. Twisted Tea products, specifically, surged 10% during the same span.

There is heavy flavor innovation in the FMB space, which explains its popularity, Jones said.

“Customers are attracted to innovation and options and, right now there is no sub-category which is innovating faster and delivering more exciting options perennially,” Long agreed. The key for retailers is to build a broad assortment of options and to merchandise that assortment around key sub-segments and electrifying brands, he noted.

Imports’ popularity spikes

The main growth engine in beer recently has been imports, Watson noted. In fact, import sales increased nearly 8% over the past year, while domestic sales dropped 4%, per Circana.

Modelo has grown rapidly in recent years and dethroned Bud Light as the best-selling beer in the U.S. by dollar sales last year. By volume, Modelo is the fourth largest beer brand, according to Euromonitor.

“We continue to see growth in Modelo, Pacifico and many other brands,” Jones confirmed.

Thanks to the success of its premium brands Modelo and Coors, Constellation Brands expects top-line growth of 8% to 9% for fiscal 2024. Despite continued inflation, Constellation’s CFO Garth Hankinson told Wall Street investors late in 20223 that consumers looking to cut back are not abstaining from premium booze purchases.

No-alcohol, low-alcohol growing

The no-alcohol and low-alcohol beer market is “doing a pretty good job at having a revival,” said Jones, noting that Athletic Brewing is leading the way.

“There is definitely some substitution of old-school Coors and Bud brands being swapped out with a new, energized beer,” he added.

In addition to Athletic Brewing, nearly every brewer has at least one beverage in this category, including Molson Coors, Diageo and Anheuser-Busch.

Those brands are growing due to consumers’ growing interest in health, new drinking occasions and their busy lifestyles. However, the non-alcohol and l/low-alcohol category is still only 1% of the entire market, according to Watson, citing Euromonitor data.

“It’s a very important segment to the industry. I’m looking forward to seeing how it develops in the next year or two,” Jones said.

Getting local can draw traffic

Despite lower overall sales of craft beer since 2016, c-store operators could have success in the sub-segment — particularly when featuring local or regional brews.

“Craft beers do remain popular – with strong loyalty to brands where those brands are developed,” Long said.

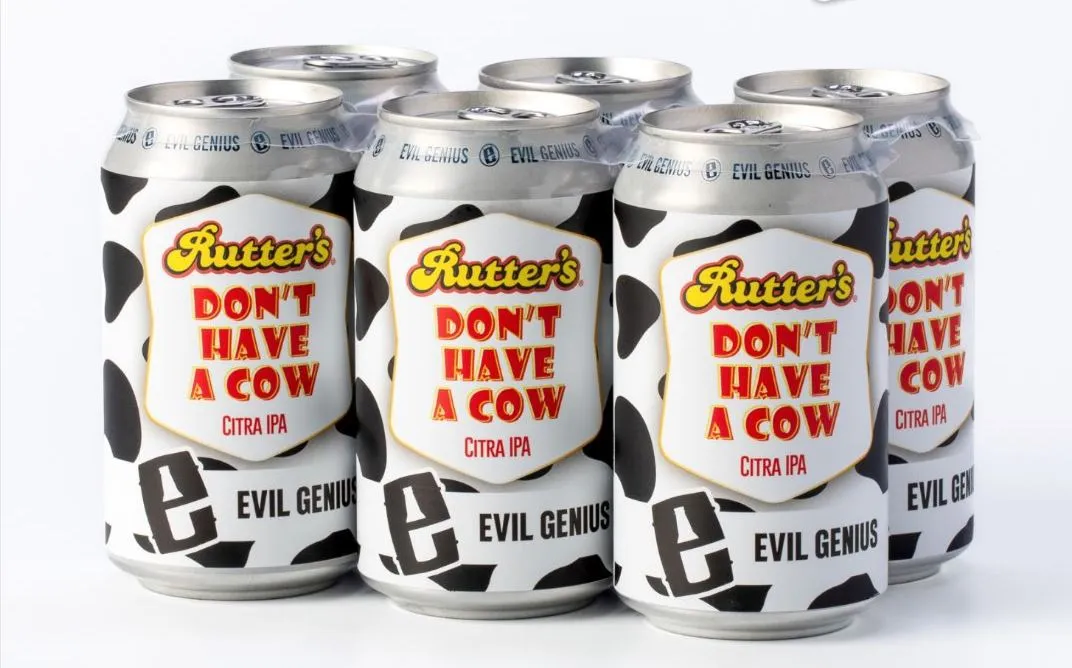

Rutter’s has notably made waves with a series of collaborations with Pennsylvania breweries to offer beverages that are unique to its stores, including a chocolate milk stout and a citrus ale with Lancaster Brewing, a holiday stout and pumpkin spice ale with Rusty Rail and a citra IPA with Evil Genius.

”We continue to partner with local craft breweries several times a year to develop and launch private label LTOs packed with seasonal flavor and which fit in nicely with seasonal consumption occasions,” said Long. “ It’s a fun way to engage with craft customers and to offer exciting products throughout the year that they can’t find anywhere else.”