From a flurry of M&A activity to the downfall of Mountain Express, 2023 was packed with storylines for the c-store industry. Will 2024 reach those same heights?

It’s hard to say for certain in such a complex, competitive and rapidly changing industry. But in speaking with experts over the past few weeks, we feel like we have a pretty good idea of some of the key themes that will emerge over the next 12 months.

Change is a word that has increasingly come to define the industry as it continues to push beyond the smokes-and-Cokes operating model. And that evolution will continue to build momentum in 2024, experts say. Store innovation, company consolidation and the elevation of foodservice to compete with, and even supersede, restaurant fare, promise to be dominant trends.

As companies deal with rising costs while consumers remain highly price sensitive, however, another word rises to the top for many industry watchers.

“I think 2024 will be the year of efficiency for c-stores,” said Art Sebastian, former vice president of omnichannel marketing for Casey’s General Stores who is now CEO of Nexchapter LLC, an advisory firm he founded.

Although inflation has loosened its grip in recent months, consumers say they’re still feeling pinched by high prices and are cutting back on non-essential items. In October, 55% of people surveyed by 84.51, a consumer insights firm owned by the grocer Kroger, said they have been cutting back on discretionary purchases like candy and snacks.

With consumers continuing to closely watch their spending, c-store operators won’t be able to drive profitability through favorable pricing, Sebastian said.

“Retailers can’t just take price anymore to drive the top line,” he noted. “And once the fuel margins ease up, every penny is worth tens of millions for a retailer.”

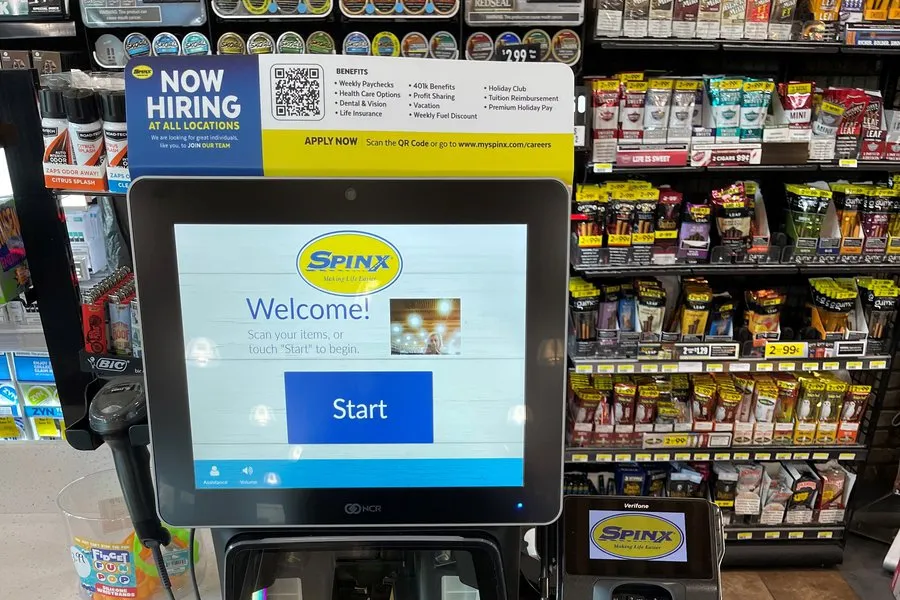

Sebastian expects companies to drill down further into labor costs by streamlining their hiring, onboarding and training processes. C-stores can automate training and make stocking shelves more efficient by utilizing an employee app, for example. Self-checkout machines can reduce staffing on the front end.

Increasing operational efficiency is a key trend we see as we look ahead to 2024, but it’s far from the only one. Here are eight other themes that promise to shape the c-store industry this year.

C-stores will work to unify their technology

One way c-store retailers will look to boost their efficiency in 2024 is through streamlining their technology efforts, said Rob Gallo, chief strategy officer for c-store consultancy Impact 21.

C-store operators will tap into “unified commerce,” or a more intentional effort to integrate their various tech software to ease customers’ experiences, Gallo said. This spans all of a retailer’s technology touchpoints to create as seamless an experience as possible.

Much of this tech unification harkens back to retailers’ efforts to engage customers during the COVID-19 pandemic, when demand for technologies like mobile ordering and delivery spiked. Almost four years later, retailers have struggled integrating various software and services with one another, which has created a “very disconnected, disjointed experience,” Gallo noted.

For example, customers’ loyalty profiles or payment information doesn’t always travel between apps or platforms, forcing customers to re-enter this info several times. This makes it difficult to send a consistent message to and engage with customers, Gallo said.

In the year ahead, filling in those gaps will be a “big focus” for retailers, Gallo said.

“Now that we understand the customer journey, let's map all this stuff out and make sure that we're serving the customer’s needs during all stages of those journeys,” he said.

Look for big flavor in foodservice

Having spent more than three years playing it safe with their spending and with COVID-19 precautions, consumers are feeling adventurous, said Jessica Williams, CEO of consulting firm Food Forward Thinking.

Restaurants are tapping into this desire with menu items that feature bold flavors and eye-catching names. Chik-Fil-A recently featured a Honey Pepper Pimento Chicken Sandwich for a limited time, while McDonald’s new restaurant concept, CosMc’s, has beverages like Sour Cherry Energy Burst and food selections like a Spicy Queso Sandwich on its menu.

Williams expects this “big flavor” strategy to make its way into c-store chains in 2024. Some have already taken up the charge, like Rutter’s and its seasonal menu, which last year featured indulgences like a peanut butter burger topped with onion rings, cheddar cheese, Reese’s peanut butter sauce and barbecue sauce.

In addition to drawing attention to a store’s foodservice department, injecting new flavors into their menus offers an opportunity for c-stores to revisit key food prep training for workers, Williams noted.

But companies shouldn’t go overboard, she cautioned. She’s noticing restaurants and c-store operators typically carving out around 10% of their menu space for eye-catching selections.

“It gives your consistent, loyal customers something new,” Williams said.

C-stores will innovate inside and outside their stores

For a long time, convenience retailers took a follow-the-leader approach to store design by copying larger chains without understanding why those larger chains made certain decisions, said Mike Lawshe, president of c-store design firm Paragon Solutions.

The emergence of more thoughtful redesigns and new formats in 2023 is a sign that’s changing, and will continue to evolve in 2024.

“The big thing for me is [c-stores] are taking the time, finally, to really look at what makes them different, what makes them better, and then coming up with their own answers,” Lawshe said.

Design changes won’t only be made inside stores. As fuel becomes less important for some retailers, convenience stores could move away from the traditional setup of fuel pumps positioned in front.

“Let's redesign the customer experience,” said Transportation Energy Institute Executive Director John Eichberger.

The growing emphasis on unique design isn’t just about standing out from the c-store crowd either, as convenience retailers are increasingly seen as competitors to QSRs, coffee shops and grocery stores.

“They're using a lot of different innovative formats around the foodservice side because that's such a big driver for c-store,” said Scott Love, senior vice president, retail client solutions for Circana.

M&A will continue, with a focus on family businesses

Consolidation will continue in 2024 since the c-store industry remains extremely fragmented. Something to watch out for this year will be more family-owned operators selling their businesses and getting out of the industry after multiple generations, Gallo and Jeff Lenard, vice president of strategic industry initiatives for NACS, noted.

“There still remains a large number of chains out there in the 10 to 100 store range that, depending on what their long-term strategy is — especially if they're family-owned businesses — may decide that they want to get out,” Gallo said.

One outsized example of this came when Kum & Go sold its 400-plus c-stores to Maverik in April 2023. When this deal closed, Kum & Go CEO Tanner Krause left the company, ending its 64-year run as a family-owned business.

Many family-owned retailers are now in their third or fourth — or in the case of Rutter’s, 10th — generation. With the M&A market busier than it’s been in recent years, owners are looking at the next generation and hoping their children or other family members want to stay in the industry.

It turns out that many of these people aren’t interested, Lenard said.

“I don't see the same passion there,” Lenard said, regarding older and younger generations wanting to own their family’s c-stores. “There's a difference between being a founder and being a third-generation [owner].”

EV momentum will moderate

Electric vehicle charging saw a lot of interest and pilot programs from retailers last year, but in 2024 the hype should die down as convenience retailers think more strategically about whether or not to add the amenity.

“In certain markets, [chargers] are going to be very important in the near future,” said Eichberger. “In other markets, they may never be important.”

EV adoption is slower than analysts had originally expected, even with new mandates from states looking to phase gas cars out entirely. Some automakers are slowing production of battery-powered vehicles and price remains a factor, meaning the EV revolution is unlikely to happen in 2024.

But whether or not retailers have EV chargers in 2024, they should at least have a plan, experts agreed.

“What shape that takes for them is TBD, but [they should be] taking a more aggressive approach to figuring it all out and what it means for them,” said Gallo.

Retailers will move toward Loyalty 2.0

C-store loyalty was a central focus in 2023, with companies like 7-Eleven and Casey’s General Stores revamping their programs, while Coen Markets and Dash In debuted theirs.

This year should bring more of the smaller and mid-sized retailers into the loyalty arena, said Matt Sargent, director of strategy analytics for Sargent Up North. For some of those firms, he expects the transition to be rocky.

“There's some there's some friction there because they tend not to have the investments in analytics and data structures that the loyalty program will require,” Sargent said.

Most chains still run what Sebastian, the former Casey’s leader, calls “loyalty 1.0” programs that are undifferentiated and not tailored to help c-stores compete across channels.

“You have to expand that frame of reference to compete and build a relationship with customers today,” he said.

With loyalty expected to remain a priority in 2024, multiple experts foresee “hyper personalization” within these platforms becoming the next step.

This essentially means refining loyalty programs to where companies are messaging customers at the right time with the offers most aligned to their interests, both Lenard and Jeff Hoover, director of strategy and insights for Paytronix, said in separate interviews.

“Knowing what [customers] are doing and why they're doing it and when they're doing it allows you to really enhance your operating efficiencies,” Lenard said.

Hoover noted that two years ago, only about half of Paytronix’s c-store loyalty clients cared about personalization within their programs. “Now, everyone wants it,” he said. “It brings more customers into their program and retains their customers in a more segmented way.”

Beverage innovation will be big

Packaged beverages have always been big for c-stores — it was the second most profitable in-store category in 2021, according to Statista — but 2024 should bring more interest in innovative options in addition to the mainstays, said Love.

“The biggest thing we're seeing in beverages is there's a hybridization of beverages,” he said.

For example, the line is blurring between energy and sports drinks, with water also starting to shift toward the latter category, Love added.

“You're seeing a lot of water that has a lot of the functional ingredients of sports drinks,” he said. “Gatorade is coming out with a water that's a competitor to SmartWater.”

He also noted that some beverage companies use c-stores as a “testing bed.” This leads to convenience retailers having an array of seasonal items, and sometimes working directly with CPG companies to offer unique items — like Circle K being the exclusive retailer for Mountain Dew’s Purple Thunder flavor.

Love said he expects more beverage manufacturers to use c-stores as a launchpad for their products in 2024.

”You can get a really fast read on their performance and engagement, and the core audience that's hitting c-stores [matches] the demographics and the target audience of the given product,” he said.

C-stores will focus on their company value proposition to attract employees

Hiring and retention is an ongoing challenge for convenience store operators. Beyond using tools like labor-assisting technologies and increased pay to hire and retain more team members, c-store retailers will also evolve their value proposition in 2024, both Gallo and Lenard said.

In other words, they will outline their purpose as an organization, Lenard noted. This could mean having a story or mission that aligns with the surrounding community, for example.

“There are people that may find you for a job not because they're thinking of working in a convenience store, but because they want to work for a company that cares about the community,” Lenard said.

One reason for the increased focus on a company’s value proposition is that younger generations — Gen Z and Millennial consumers who comprise a large portion of today’s workforce — seek these purpose-driven missions, Gallo said. Consumers of these generations also engage with employers much differently than previous age groups had, he noted.

“Are we making sure that we're updating and evolving with the times just like we update and evolve with the customer?” Gallo said. “Younger generations are paying attention to how you do that, and decide where they want to work based on what they understand about who you are.