7-Eleven has found a way to make rewards customers even more loyal through its fuel price lock tool.

In Seven & i’s earnings call last week, the parent company of 7-Eleven Inc., noted that in addition to getting coupons for fresh food or drinks, members of its loyalty program 7Rewards have taken advantage of the fuel price lock feature in the company’ mobile app.

Customers who used fuel price lock had a 90% higher store visit frequency than other members of the loyalty program, according to the company’s earnings presentation.

Additionally, “57% of fuel price lock users purchase items in store,” said President and Representative Director Ryuichi Isaka in the company’s presentation.

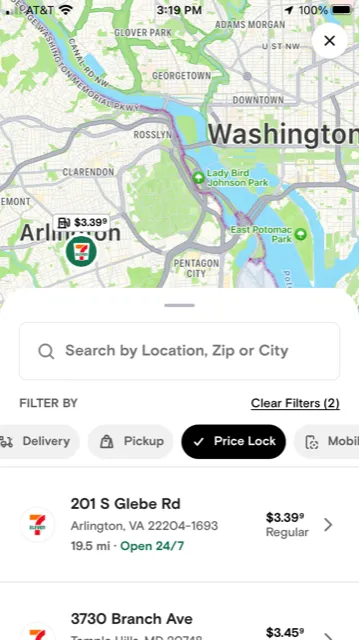

The fuel price lock tool enables customers to select which fuel grade they want to use. The app then looks at the local participating stores and finds the best price for that type of gasoline or diesel.

Once locked, the price is good at participating stores for four days, according to the app. If the price at the store is lower than the one a customer locked earlier, the lower price will be honored.

“We therefore seek to respond to the current challenging consumption environment by enhancing our offering of proprietary products and by leveraging digital technologies to drive in-store trips,” said Isaka.

7-Eleven’s price lock tool isn’t brand new — the retailer introduced it in 2021, according to a company spokesperson. But it appears to be striking a chord with price-conscious consumers who have been battling price inflation for more than a year.

Price lock is not a widespread feature for c-store apps. United Dairy Farmers’ app features it as a way to stand out from competitors. That price lock tool enables the customer to get the lowest gas price of that day, even if the price has risen since that point.

Other takeaways from the Q2 earnings:

- Warabeya North America, which makes grab-and-go foods for 7-Eleven stores, opened its Virginia facility in September. At the end of September the site was distributing items like sliders, sandwiches and breakfast tacos to 278 stores, but the company plans to expand that reach to 1,300 stores by the end of 2023.

- Also in September, Seven & i completed transfer of shares in department stores Sogo and Seibu. Much of the proceeds will be distributed to other parts of the business, with a “special emphasis on convenience store operations,” said Isaka.

- North American convenience stores was the company’s only business segment that saw a year-over-year drop in revenue. One factor the company highlighted for the drop was California’s flavored tobacco ban. With a sixth of the company’s North American stores in that state, the hit to tobacco sales pushed down overall “year-on-year existing store sales by just under 1%,” the company wrote in its earnings Q&A.