The first half of 2023 was crowded with big stories for c-stores.

Well-known retailers like TravelCenters of America and Kum & Go got bought up in an M&A bonanza. Inflation continued to pressure small and large retailers alike. Multiple companies took a hard look at their technology and made improvements, from apps and websites to loyalty programs and in-store systems.

As we’ve shifted into the second half, which of these trends will remain top of mind for retailers?

Here are five storylines to keep an eye on through the rest of the year.

What M&A deals will happen next?

This year has been nothing short of explosive for convenience store mergers and acquisitions. Two deals that have yet to happen, though, are the sales of Mountain Express Oil and Irving Oil.

Mountain Express, which operates 171 retail and fueling stations and 27 travel centers in over half the U.S., filed for Chapter 11 bankruptcy in late March. According to court documents filed at the time, the company said it would explore a sale of its assets.

In June, Irving Oil, which owns over 1,000 gas stations, c-stores and truck stops in the northeastern U.S. and eastern Canada, said it would consider a full or partial sale as part of a strategic review regarding the future of the company.

Both companies have been on the sale block for some time now, and their assets promise to generate interest throughout the industry.

The boom in loyalty-program revamps

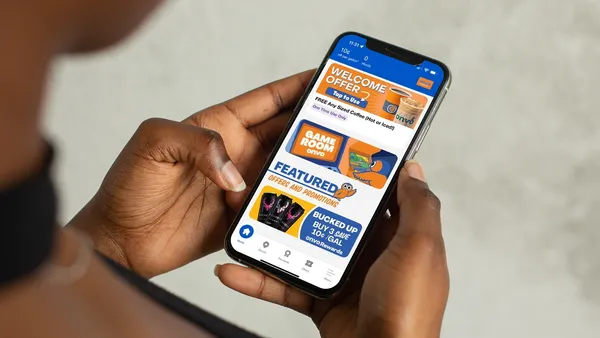

Several convenience retailers have revamped their rewards programs as a means to curb the industry’s backslide in loyalty participation over recent years.

Casey’s General Stores, Circle K, Kum & Go, Stinker Stores and Parkland are some of the major retailers that have rebooted their programs, with many of these platforms receiving updates for personalized offerings, new member deals, upgraded app interfaces and unique ways to earn points.

Moving forward, convenience retailers that upgrade their loyalty programs put themselves in a better position to give their customers a sense of familiarity, which can then improve the consumer-brand relationship, Matt Sargent, director of strategy analytics for Sargent Up North and a former director of loyalty analytics for CPG consultancy Big Chalk, said in a previous interview.

With rewards participation having fallen between 2019 and 2021 compared to industries like restaurant and grocery, according to a Paytronix report, c-stores still have plenty of room to grow in the loyalty category.

Will the executive shuffles continue?

Several large and mid-size convenience store retailers have undergone major changes atop their executive teams so far this year. With so much change happening around the industry — from retailers expanding to new markets and testing unique store formats to embracing today’s energy transition — many of these leadership shifts underscore the new goals these companies are looking to achieve.

Pilot, TravelCenters of America, Foxtrot, Neon Marketplace and Breeze Thru Markets all named new CEOs earlier this year, while 7-Eleven, Wawa and GetGo Market & Cafe appointed new company presidents. Meanwhile, EG America has named two interim presidents over the past couple months as it seeks a new permanent leader.

As 2023 reaches its final few months, the c-store industry probably hasn’t seen the last of these major executive shifts.

EV charging moving from big plans to big rollouts

With the world planning for a move away from internal combustion engines and the gasoline that powers them, many convenience store owners have at least considered adding EV chargers.

Some chains, including Parkland, EG America, Phillips 66 and Loop Neighborhood Market, have tested the waters at one or more locations, with plans for a handful up to a few dozen chargers.

But some companies have already made broader plans for their EV infrastructure. For instance, 7-Eleven has its sights set on 500 charging stations at 250 stores in the U.S. and Canada by the end of 2022. Circle K set a goal of 200 charging sites by 2024. TravelCenters of America is aiming for 1,000 by 2028, and Pilot is targeting 2,000 charging stations at 500 locations.

However, many of these rollouts have been slow, with some retailers having experiencing hiccups along the way. As 2023 winds down, will these ambitious plans turn into reality?

National Electric Vehicle Infrastructure (NEVI) funding might help. Grants started in July, with Ohio announcing the first 27 recipients. Convenience stores took more than half of those grants, worth millions of dollars, to help create charging stations.

Will inflation’s impact ease by year’s end?

Inflation has been a blessing and a curse for convenience stores in 2023. Worried consumers are buying fewer items, but price increases have offset the volume declines — so far.

While c-stores are more resilient in the face of inflation than many retailers, Goldman Sachs recently pulled back on its forecasts thanks to the impact of increasingly high interest rates.

“If you’re saving more, that’s less money that you’re going out and spending on goods or services,” said Jason English, lead equity analyst at Goldman Sachs, in a recent webinar.

But things may be turning a corner. The U.S. gross domestic product grew faster than expected in the second quarter, and the overall cost of goods rose by just over 0.1% in May, though consumers remained hesitant to spend.

Additionally, the Federal Reserve is no longer forecasting a recession, and consumer confidence has risen for the past two months.

Some c-stores have been boosting private label options to meet the needs of price-conscious shoppers, but retailers will be watching to see if a true turn in sentiment can start boosting volume again before the end of the year.