The past year has been stressful for many convenience retailers.

Inflation made customers more careful with their money. Economic pressures weighed on some major companies and pushed many smaller ones out of the industry entirely. The federal government promoted the use of electric vehicles, leaving c-stores concerned about their forecourts, where about 80% of the liquid fuel in the U.S. is sold.

But next year could bring brighter skies. Inflation has fallen, the U.S. has clarity about who will lead the federal government and the world keeps moving further from the depths of the COVID-19 pandemic.

John Eichberger, executive director of the Transportation Energy Institute, shared optimism about the fuel industry.

“I think the industry is in much better shape than it was a couple months ago, just from a messaging standpoint and a feeling of ‘what's the fuel market going to do?’” he said.

That doesn’t mean retailers can relax — prices are still a concern for customers and c-stores, and the industry is still trailing others in many areas of technology and foodservice. But if the climate grows more accommodating, retailers can capitalize.

“If I were to make a theme for 2025, I would call it future proofing,” said Art Sebastian, CEO of c-store advisory firm NextChapter. “What am I going to do to make sure I differentiate and stay relevant for years to come?”

Other experts interviewed by C-Store Dive spoke about retailers potentially reaping the benefits of automation and information while refining their customer offerings. Foodservice remains a focal point, as does consolidation.

Here are nine trends likely to absorb the c-store industry in 2025.

Only unique independents will survive industry consolidation

M&A has roiled the convenience store industry in recent years. It was especially prevalent in 2024, as large chains such as 7-Eleven, Alimentation Couche-Tard — parent of Circle K — and Casey’s General Stores regularly acquired smaller retailers who’ve struggled to thrive amid economic headwinds brought on by COVID-19.

Several experts agree that today’s difficult operating environment for smaller retailers — and the consolidation that has come with it — will continue in 2025. Although it’ll impact retailers of all sizes, operators with less than 10 stores in their networks will especially feel the heat, experts said.

“I think at some point, I don't know if [being a retailer with fewer than 10 stores] makes sense anymore,” said Kevin Farley, chief client officer for c-store consultancy W. Capra.

Unless these smaller companies can truly differentiate themselves with a niche product offering or strong connection to their communities, the difficulties of today’s operating environment might outweigh the rewards of staying in business.

Sebastian said that many of the retailers that were acquired in 2024 lacked that uniqueness.

“They're fine operators, but they're generic enough that a larger operator can acquire them and install their own programs and see synergy,” Sebastian said.

The Trump administration will bring change for c-stores

With a new presidential administration taking office in January, c-store operators should keep an eye on shifting priorities for regulations and funding.

This could have a big impact on c-stores that offer gas, especially liquid fuels, according to Eichberger.

“I think it’s reasonable to expect that the tailpipe rules… that most assume require two thirds of [vehicle] sales in 2032 to be electric? Those are going to be changed,” said Eichberger.

While he said he doesn’t expect EV adoption to stop, it will probably grow in a more organic way next year. This means stores can build infrastructure based on customer demand, rather than to prepare for government-mandated shifts.

Retailers will also want to see if President elect Trump implements tariffs, which could increase prices on many imported items, said Bruce Winder, a Canadian retail analyst. With many customers still spending frugally due to an extended period of high inflation, c-stores may see an opportunity.

“I think that retailers will continue to develop their own private label,” said Winder. “It just makes a lot more sense. It really helps their profits, and they can control who they buy from.”

And while predicting the future is impossible, Don Burke, who recently retired from his role as senior vice president of Management Science Associates, said it seems “unlikely” that a federal menthol ban, which has been delayed several times already, will go into effect.

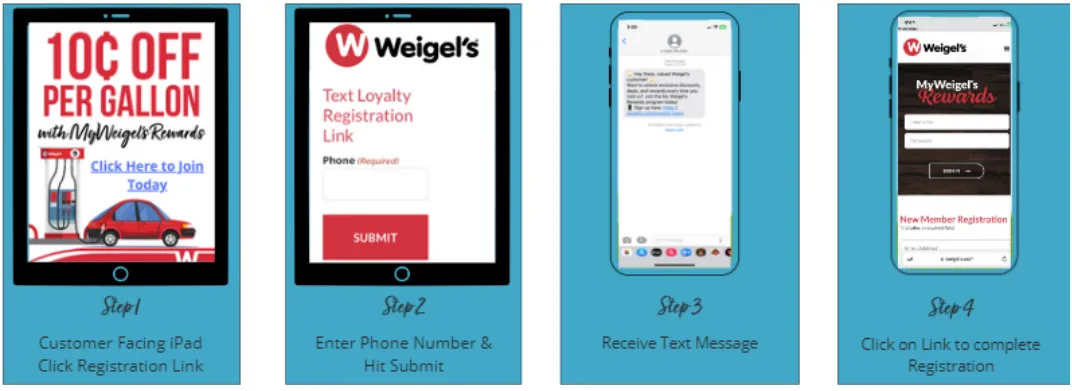

C-stores will re-evaluate their loyalty strategies

Convenience retailers have spent the past several years investing in mobile rewards and loyalty platforms. But while customers typically like these programs once they’re enrolled, the industry as a whole continues to lag when it comes to loyalty participation.

According to Paytronix’s 2024 Loyalty Trends Report, the highest-performing QSRs sign up an average of 110 new loyalty members per store each month. Meanwhile, leading convenience retailers only add an average of 36 new members per location each month.

Farley suggests this issue stems from the c-store industry prioritizing discounts and deals over the in-store experience. Retailers need to consider why customers visit their locations in the first place and center their loyalty programs around that, he said.

“You have to give [customers] reasons to walk in the door, and it's not through your loyalty program,” he said.

Farley believes c-store retailers can improve their loyalty participation by emphasizing their unique strengths, such as foodservice programs, clean restrooms and, above all, a unique product assortment that will attract customers, he said.

“The Coca Cola they're buying is the exact same Coca Cola in every single c-store,” Farley said. “You have to change what you offer outside of this traditional c-store offering for them to come into your store.”

Couche-Tard will make a splash one way or another

When Couche-Tard revealed it submitted a bid to acquire Seven & i, the parent company of 7-Eleven, back in August, experts said that the chances of a deal commencing were slim.

Nearly half a year later, that sentiment hasn’t changed. Experts said they don’t think the deal will happen, especially after one of Seven & i’s largest shareholders submitted a larger counteroffer that would take the company private.

“That sounds like it has some legs, and that avoids the whole issue as it relates to Japan not wanting a foreign company to own one of their national champions,” said Winder.

But Winder still sees Couche-Tard making a big move in 2025 even if the Seven & i bid flops. He emphasized the company’s thirst for acquisitions in recent years as a sign that it will likely continue to look for more.

A move in 2025 could even include deals outside of the convenience store industry. Winder pointed to Couche-Tard’s short-lived investment in cannabis company Fire & Flower and its failed bid to purchase French supermarket chain Carrefour as examples.

“If they don't get Seven & i, they're probably going to look at someone else,” he said.

Downshifting on EV charging

While the Trump administration may not earmark new money for EV charging, the NEVI funding many c-stores have secured is still in place, Eichberger said. And EV charging will continue to see organic growth as consumer demand for EVs increases. Eichberger added that the top selling vehicle group in the country last year was the crossover utility car, and the most popular version of that was the Tesla Model Y.

Even more than last year, the focus for c-stores will move away from building charging infrastructure to making those drivers feel welcome — and encouraging them to do more than just charge.

EV drivers want safety — clean, well-lit chargers with security cameras, located near the door — along with amenities like clean bathrooms, 24-hour foodservice or playgrounds.

Most retailers don’t meet these standards, however, Eichberger noted.

“Maybe 55% to 70% of the stores we surveyed had some of those, but almost none had all of them,” said Eichberger, citing results from a 2024 study by the Transportation Energy Institute. “So there's a huge opportunity.”

Hybrid foodservice programs will rise

The battle between made-to-order and grab-and-go foodservice in convenience stores continues to heat up. Retailers such as TXB and Twice Daily are going all-in on menus of customizable options, while others like Kwik Trip and Maverik are sticking with the traditional, speedier premade format.

Multiple experts agree that c-store retailers can find success with both approaches. Tailoring the food program in each store to its customers’ needs and demands — and doing so profitably — is what’s most important.

“I think everyone understands at some level you need a foodservice program,” Farley said. “Whether that's full-on Casey’s-style pizza, that's up to you and your team to figure out.”

Rachel Toner, a c-store foodservice consultant who spent nearly seven years on Wawa’s product development team, said advances in food technology and engineering are helping retailers optimize both formats. Toner emphasized that consumer preferences should push retailers to offer both formats, with Gen Z and millennials leaning towards experiential made-to-order menus and older consumers preferring quick grab-and-go.

“I don't foresee that one will dominate one or the other completely,” she said. “I think this hybrid model allows people to have the best of both worlds.”

AI will continue to emerge inside the store

Although convenience retailers continue to integrate new technologies, the industry has been slow to embrace artificial intelligence. Some of this hesitance has come from retailers being unable to justify the costs, while others simply don’t understand how AI can benefit them.

Still, small and large c-store retailers alike are taking the plunge. 7-Eleven has credited its AI scheduling assistant with cutting the company’s hiring process from 10 days to three per candidate, while Loop Neighborhood Market uses AI to provide daily sales and margin reports to its employees.

As labor and supply chain hurdles continue in 2025, more c-store retailers are going to have to tap into AI, Sebastian said.

“Replace anything that's on a clipboard and requires a pen,” Sebastian said.

Sebastian sees an opportunity for c-store retailers to tap into voice AI, which imitates how people communicate. Sebastian previously helped Casey’s launch an automated voice assistant for its pizza orders.

“There's so much more voice AI technology out there, whether you're in a cooler and you're counting inventory and it's speeding the system, or you've now got voice AI on the sales floor, listening to and recording the conversations,” he said.

Tobacco isn’t dying, but it’s changing

The long-term drop in nicotine use is old news, but it may not be as bad as the numbers paint, said Burke, the former senior vice president of Management Science Associates.

Still, the category is shifting.

Deep discount cigarettes will continue growing in 2025, Burke said, thanks to price-conscious shoppers and faster price hikes on brand names.

But a bigger shift in the nicotine space is moving toward “modern oral,” especially nicotine pouches, which have been so popular that some manufacturers have had trouble keeping up with supply. Sales grew over 50% in 2023 and grew another 50%-60% in 2024, Burke said.

Nicotine pouches are tobacco-free and can be used in many places where smoking or vaping is prohibited.

Modern oral products could become the third-largest nicotine category behind cigarettes and large cigars “in the next couple of years” if the current trend continues, Burke noted. And convenience stores are the main purveyor of these products.

“It really is an opportunity for c-stores to capitalize on not only how this product is growing, but also in the fact that consumers really do rely on convenience/gas for the purchase of this product,” said Burke.

C-stores will find ways to use their first-party data

As convenience stores increasingly introduce or update loyalty programs, offer online ordering and expand email, SMS and other direct outreach, they’re not just creating incentives for customers to return. They’re also generating another valuable resource — first-person data.

Learning to safely and legally store and use this data can cause headaches for retailers, noted Sebastian. But he and other experts agreed that first-party data can also be an opportunity, even beyond using it to target advertising or craft the perfect product assortment in house.

“If you have these retailers that are looking for additional revenue streams and are willing to test some things out, we're starting to see some more and more opportunities for selling data,” said Austin Burns, president and CEO of c-store design firm Paragon Solutions.

Burns noted that using first-party data can result in a virtuous cycle, where the better the food program and more attractive the store, the more customers will come in, which results in more data to sell and tie back into the business.

“I think it's in its infancy stages right now,” said Burns. “But I definitely think it's coming … and it's going to be interesting to watch and see how that progresses in our world.”